August 2020 saw the number of Covid-19 cases in the US begin to stabilize and much of Europe open for business, with the UK government encouraging its citizens to kickstart the economy with its ‘Eat Out To Help Out’ scheme – even if this may now seem problematic.

Consumer confidence in the US is back to levels seen in mid-April, with increased optimism of a quick economic rebound. Meanwhile, economic pessimism in the UK & EU has decreased steadily since May.

As a result, the North American market has seen a very modest decline from July but holds strong year-on-year. On the other hand, the UK+EU have seen sales growth in August as it returned to some sort of normality.

Let’s get into those August numbers:

- North America saw a rise in both traffic (+27.85%) and sales (+17.16%) YoY compared to August 2019. However, there was a dip from July with August traffic -3.69% & sales -6.80% MoM. It is clear that consumers are shopping with intention, with search traffic +32.12% YoY and the conversion rate +18.70%.

- The UK+EU saw traffic fall from July levels (-4.98%) but remained a robust +40.18% YoY. Despite the drop in traffic, sales were +3.88% driven by strong AOS and conversion rate improvement (+9.75% MoM).

- Segment results remain mixed. General Merchandise was the only segment with strong growth in sales MoM from July 2020 to August. All other segments saw declines month over month.

Let’s dig into this past month’s segment numbers:

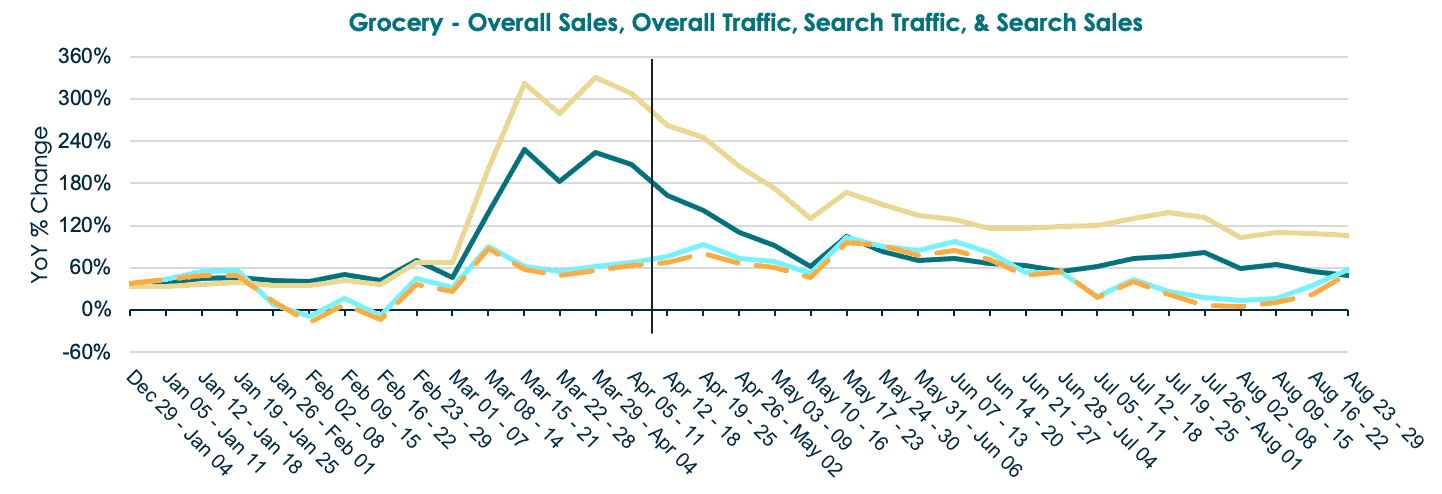

The grocery segment continued to see a dramatic increase in search traffic (+108.10% YoY) and a robust conversion rate improvement (+21.28% YoY). This led to the segment holding sales steady (+2.02% MoM), despite search traffic being down (3.70% MoM).

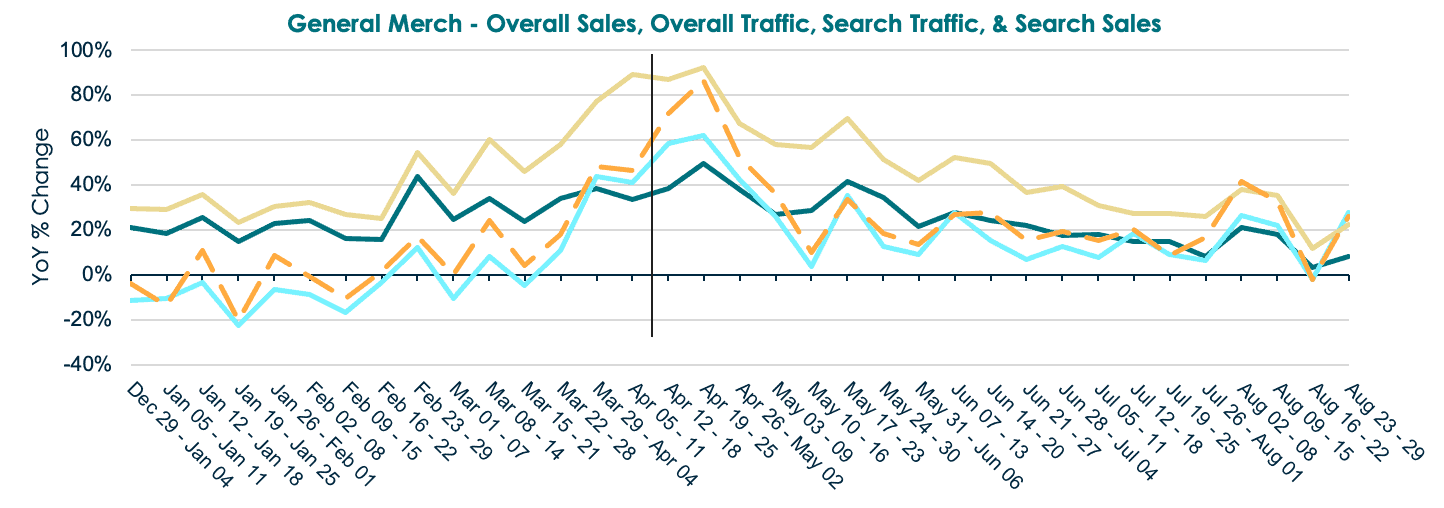

General Merchandise was the only segment with strong month-on-month sales growth (+5.22%). This growth was achieved despite traffic only being up 1.84% month on month, which is a testament to the strong growth in AOS MoM (+17.73%). The segment looks particularly strong at the moment with sales +18.33% YoY.

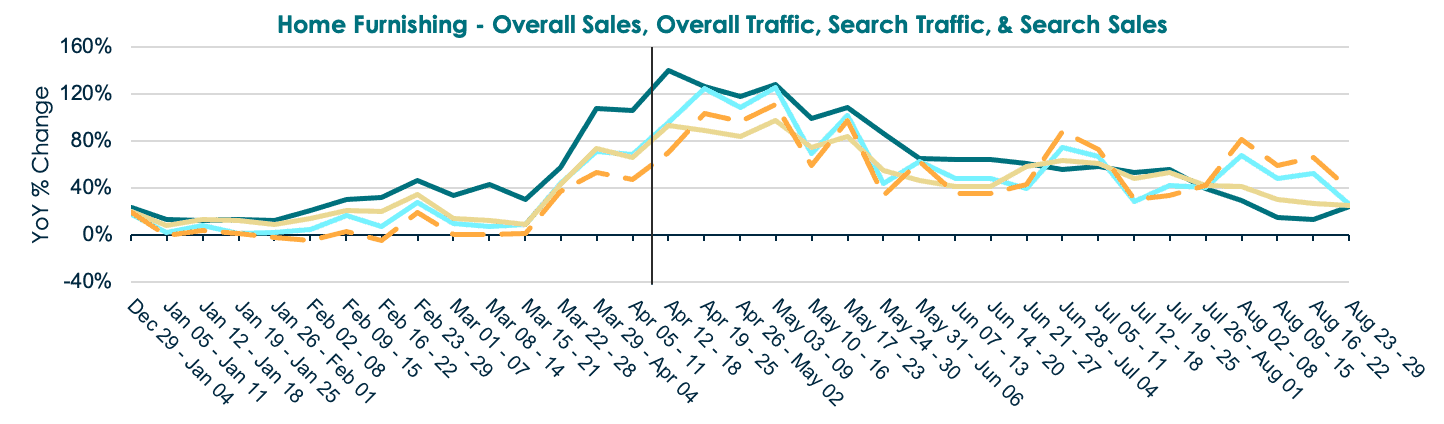

It looks like the Home Furnishings boom is starting to fizzle out, as August witnessed a big drop in traffic MoM (-15.25%). For now, sales hold steady, based upon dramatic growth in AOS and conversion rate. 2020 has definitely been the year that consumers improve their homes, with YoY sales +47.30.

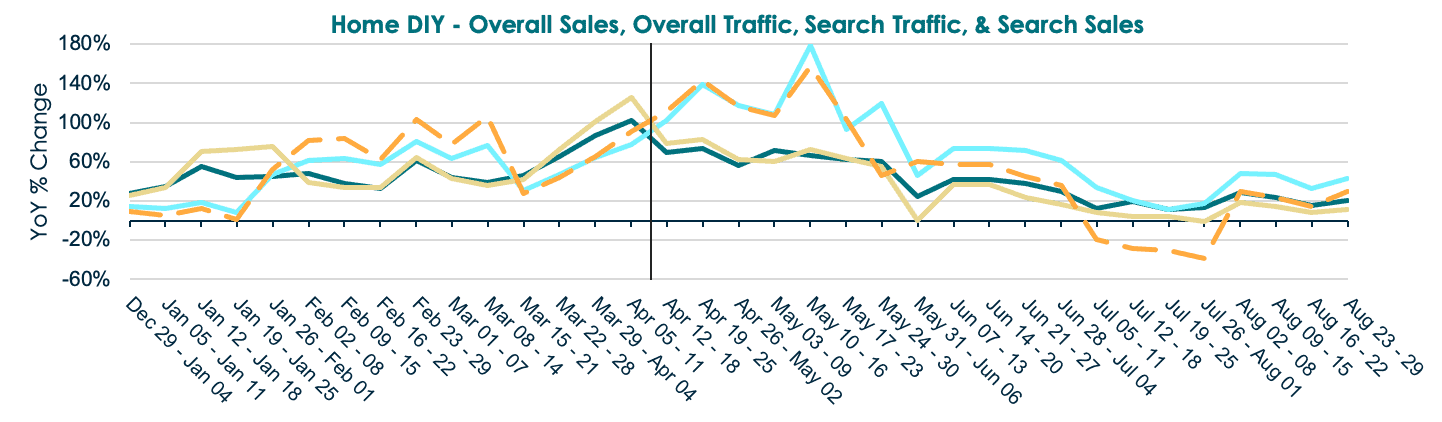

With summer coming to an end, it seems many consumers are downing tools and leaving home improvements for the time being as sales are down 10.65% from July. The sector’s conversion rate saw a massive YoY increase (+183.39%) but AOS was down -60.08%, so it appears consumers are buying less but in a targeted fashion.

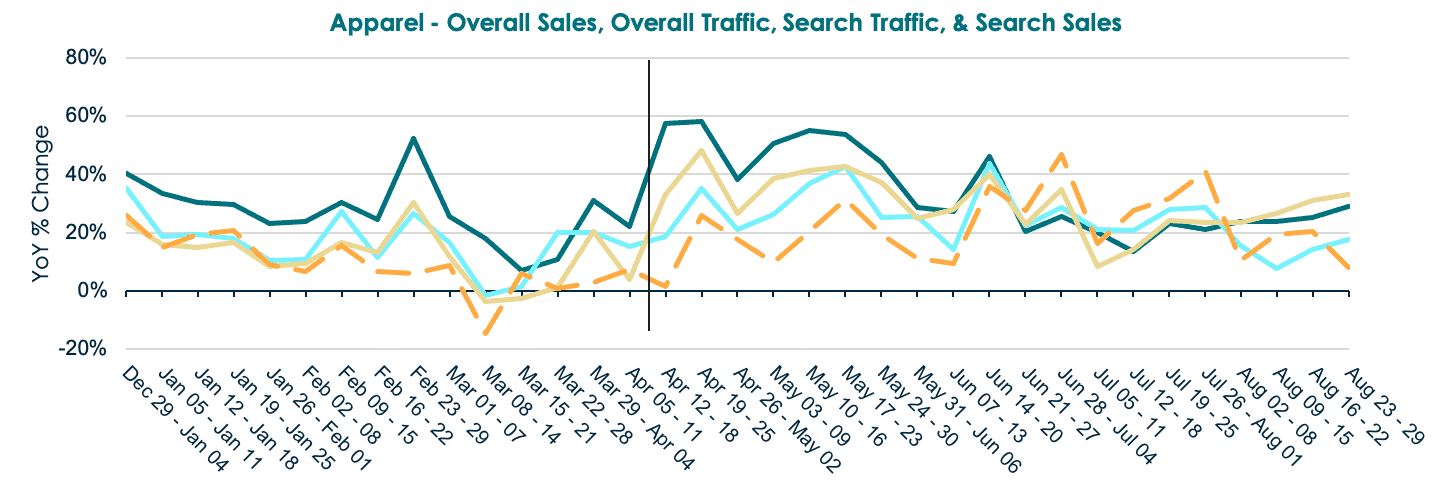

August is traditionally a big month for apparel with the back-to-school shop in full swing, but this year has been a little different. With many schools remaining closed, it was actually a very tough month for the sector with sales down -9.32% from July. YoY sales and traffic were both up, but AOS dropped as lower cost apparel made up the basket.

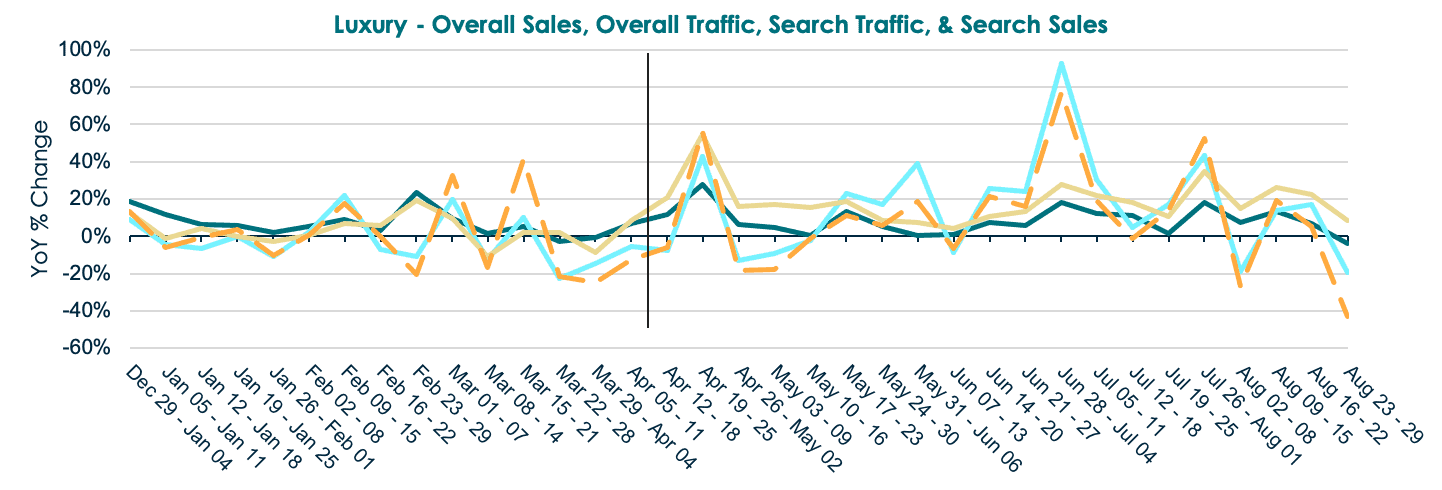

The luxury sector continues to struggle in August, with both traffic (-5.35%) and sales (-18.06%) down MoM. It isn’t just MoM that the sector is struggling with, as YoY growth of +4.78% was the lowest of any segment. One silver lining is that search traffic was up +16.03% YoY, which suggests frugal consumers are on the lookout for a deal at the moment.

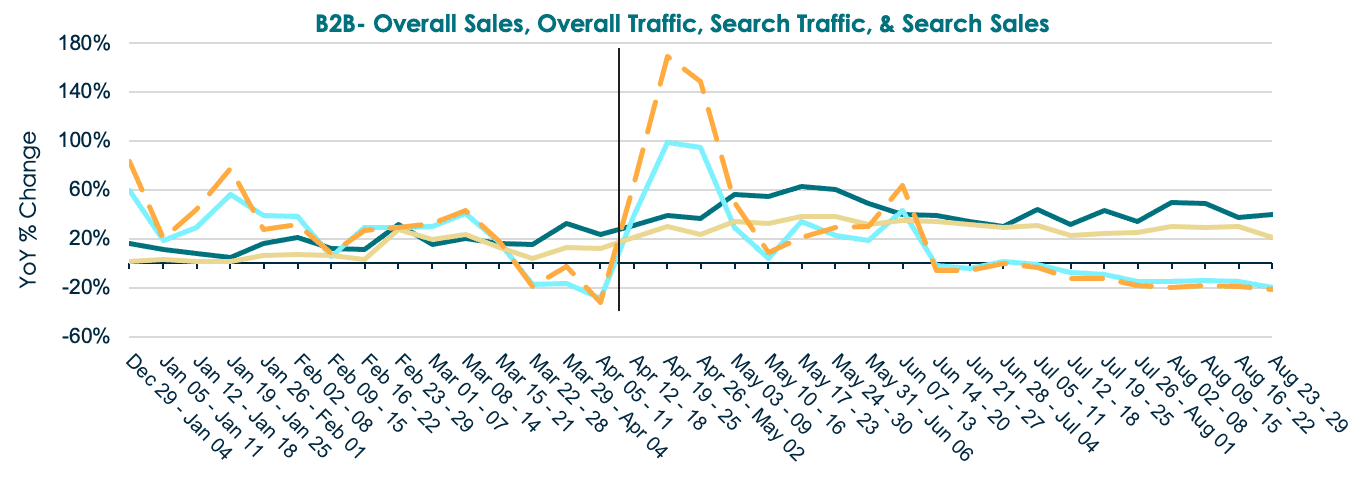

August seemed to be browsing season for B2B, with traffic up but sales down – both MoM and YoY. The key factors that caused this were steep falls in both conversion (-40.31% YoY) and AOS (-31.79% YoY). It would appear that smaller baskets and out-of-stock key PPE items are the main contributors.