FINANCE & INSURANCE

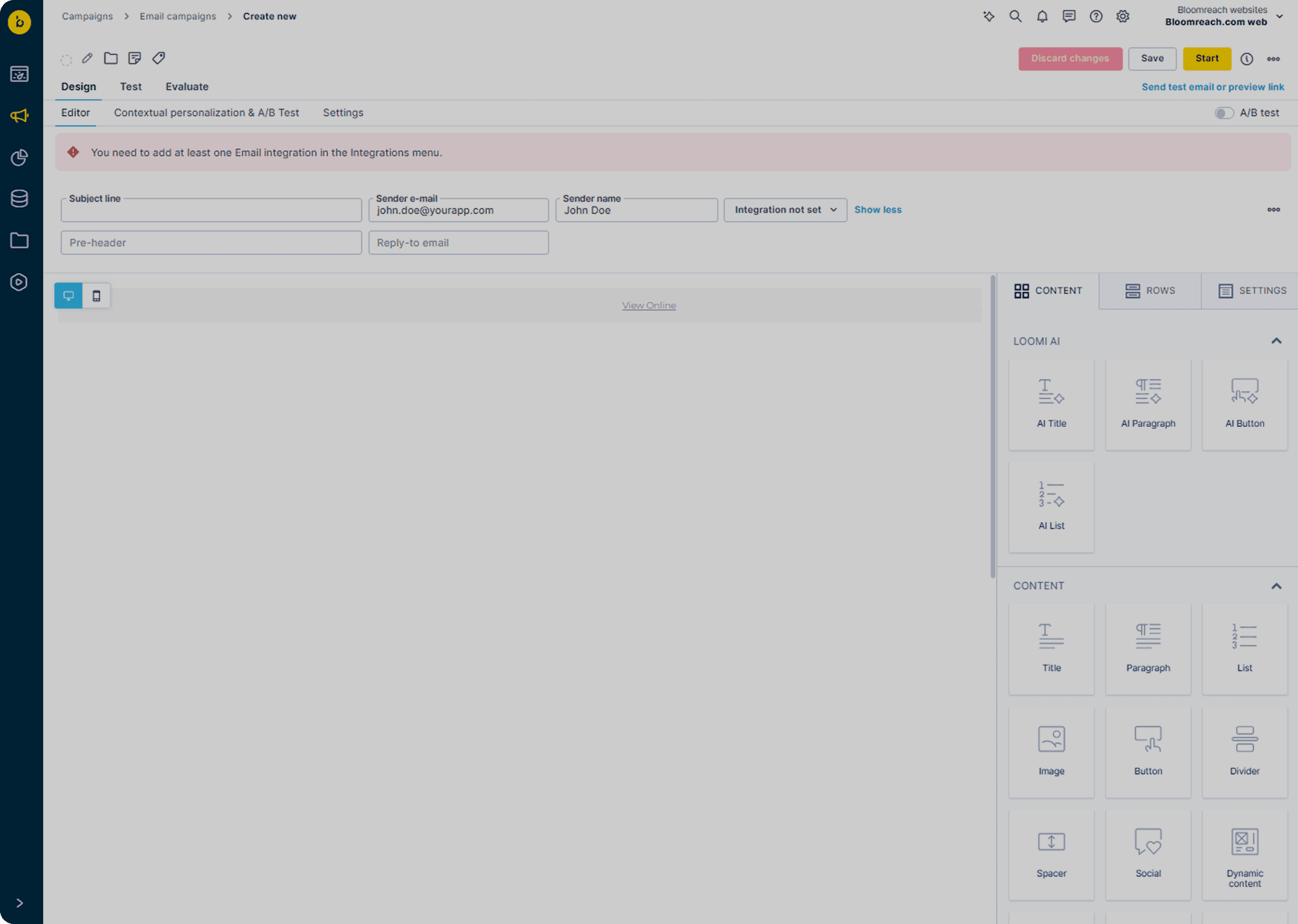

Send Emails That Feel Personal and Build Trust

Finance marketers face a tough choice: personalize to compete, or lock down data to stay compliant.

Bloomreach lets you do both — unifying customer data with built-in compliance controls so you can send relevant, timely emails that build trust without legal risk.

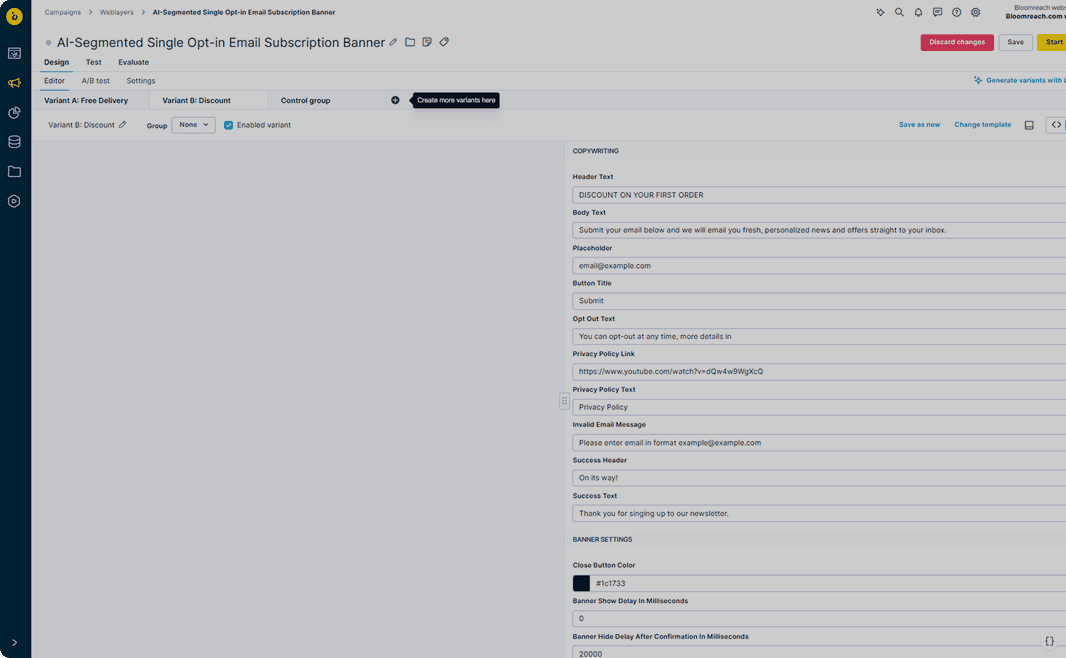

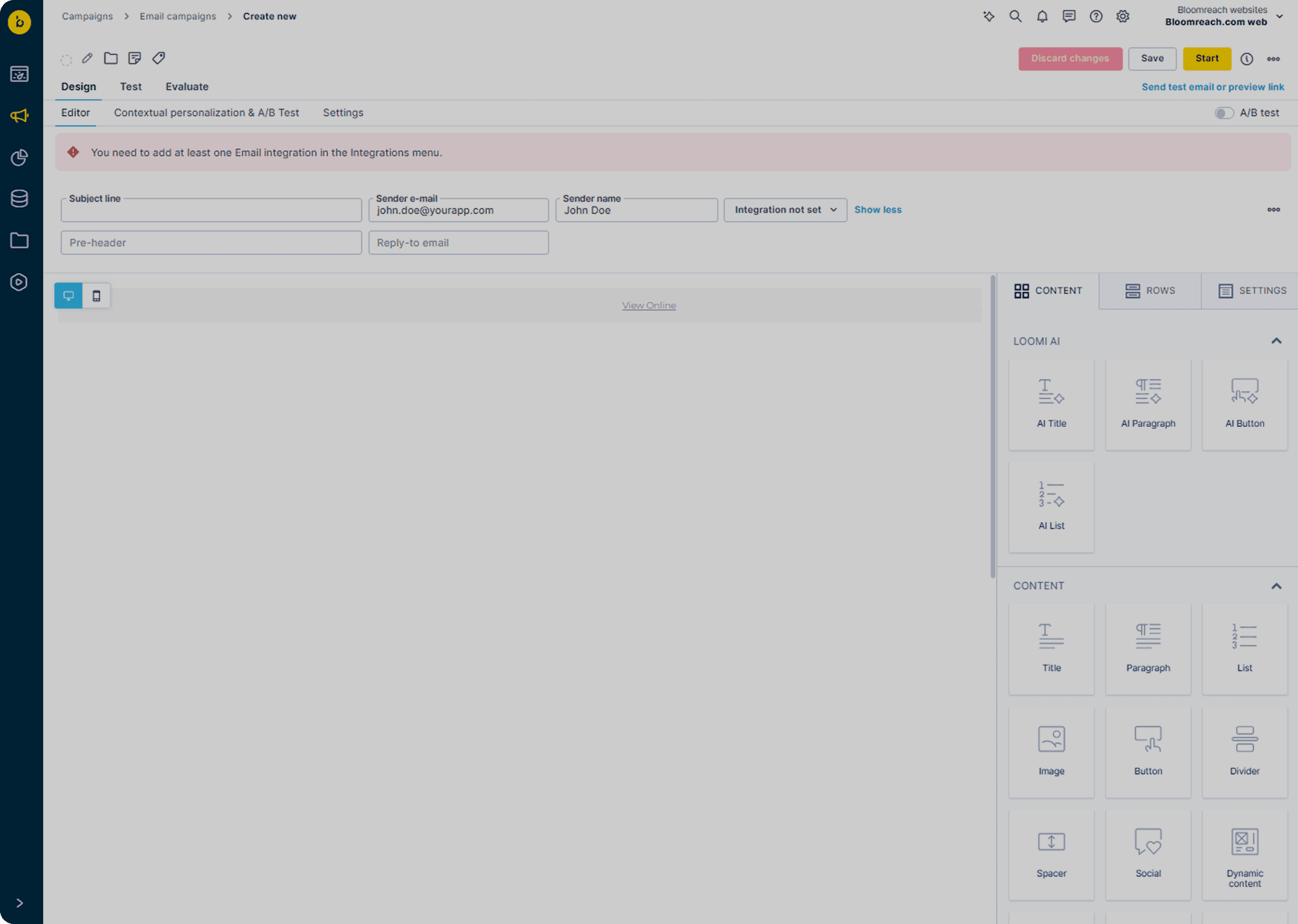

Start Anywhere, Do Everything

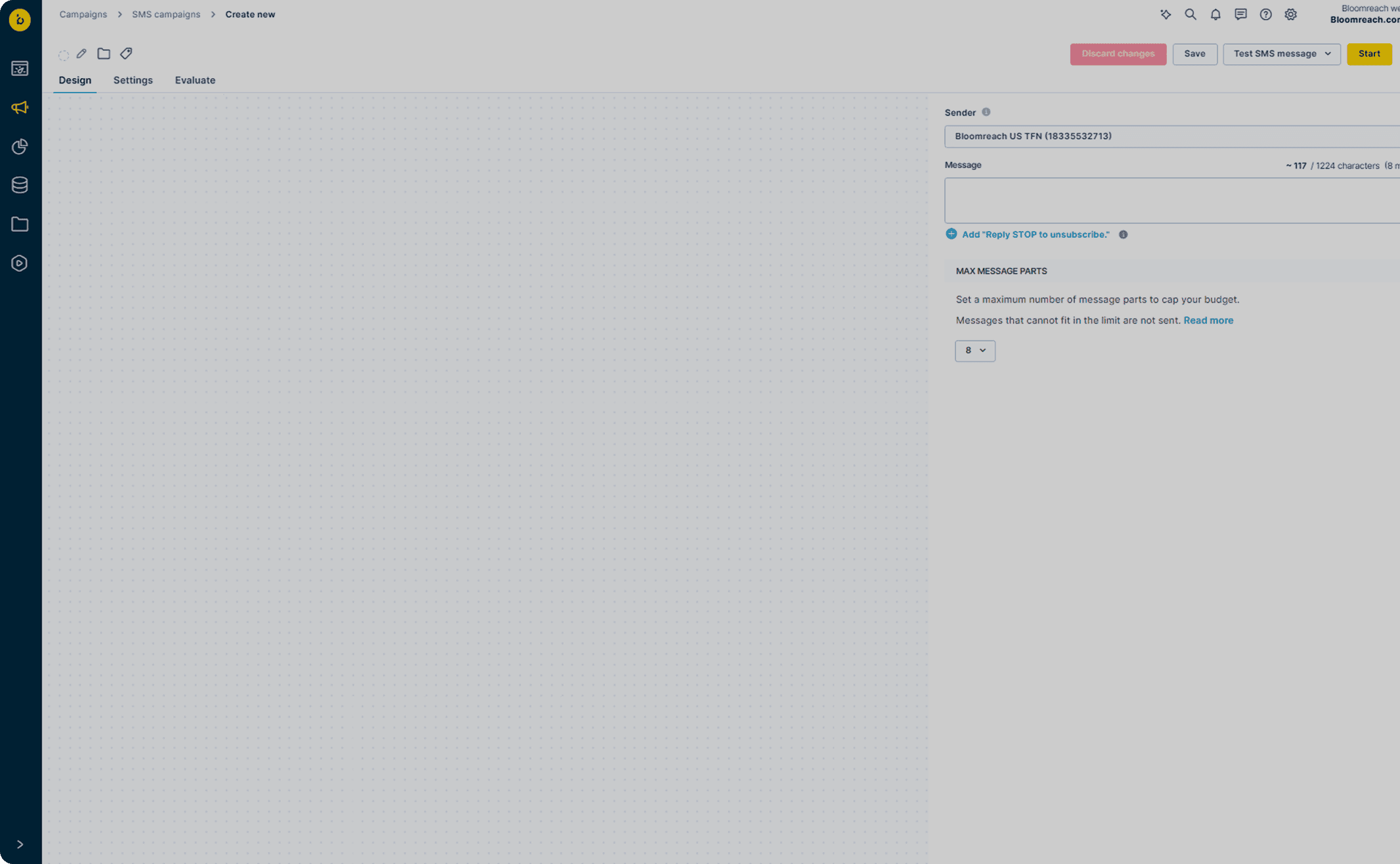

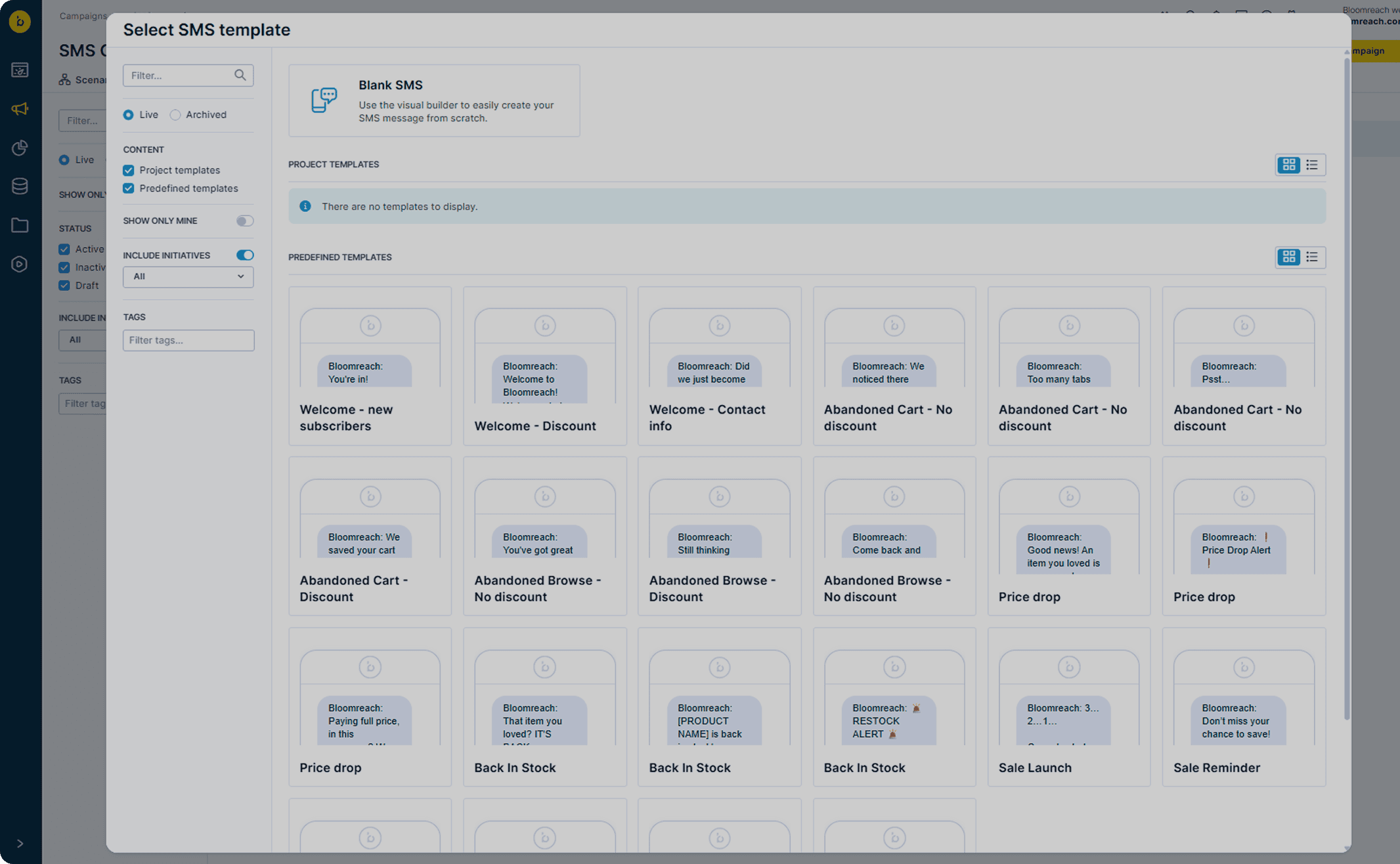

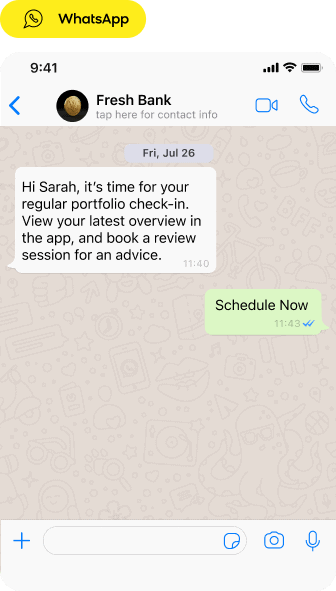

SMS & RCS

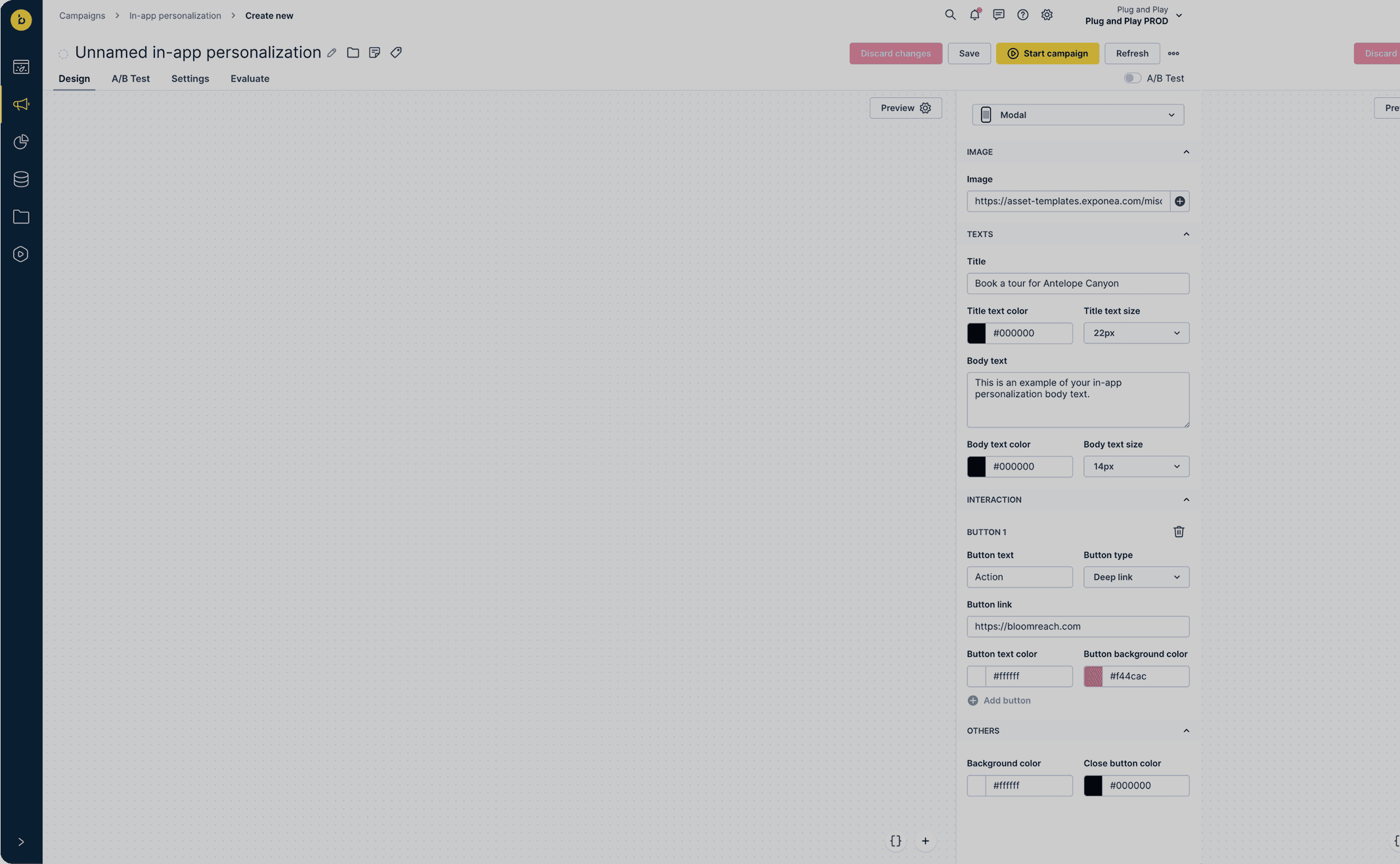

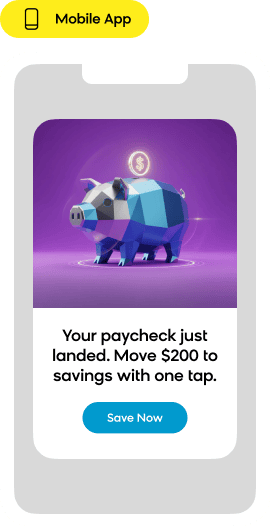

Mobile App

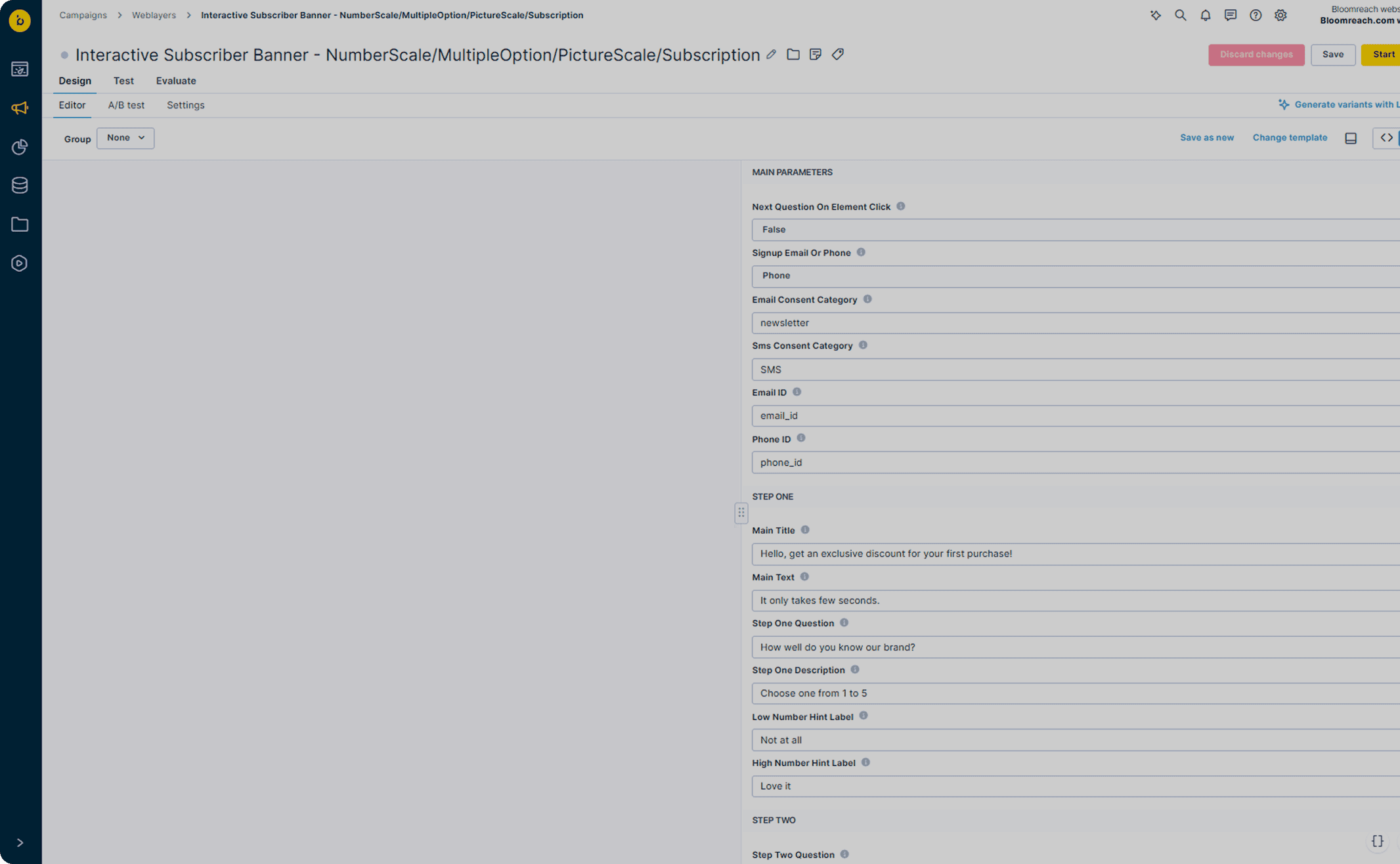

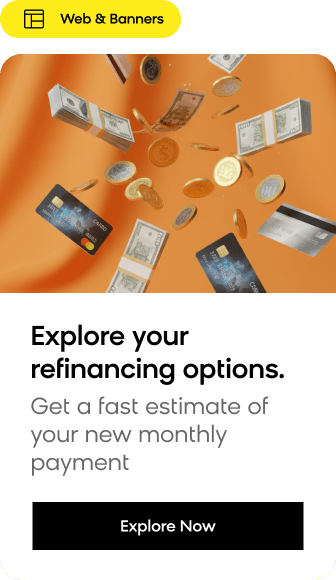

Web & Banners

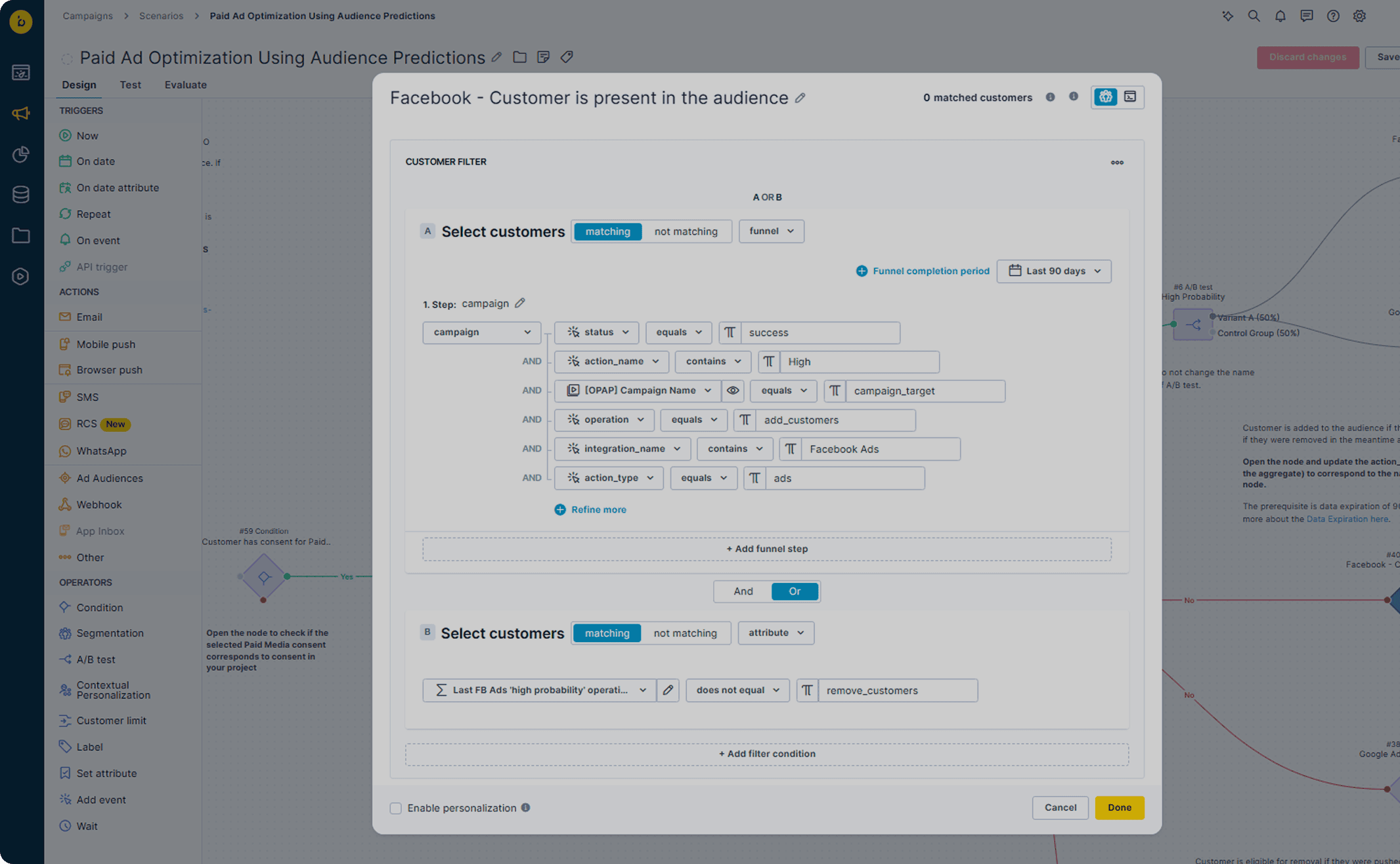

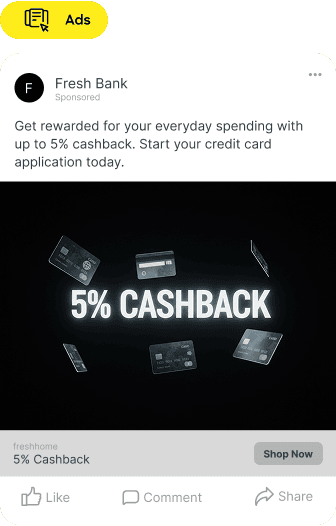

Ads

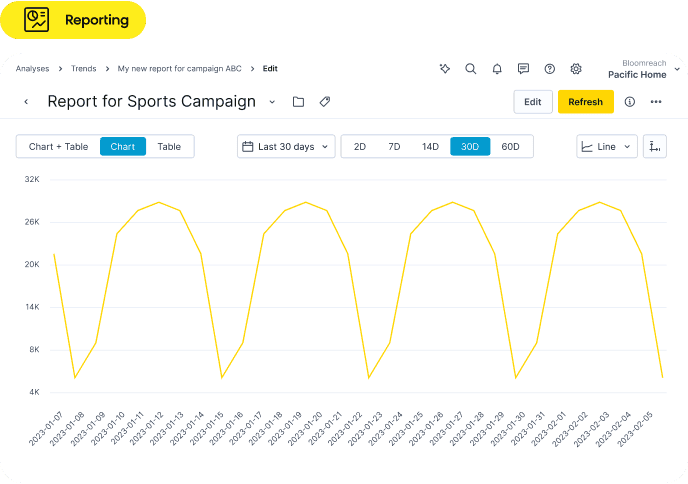

Reporting

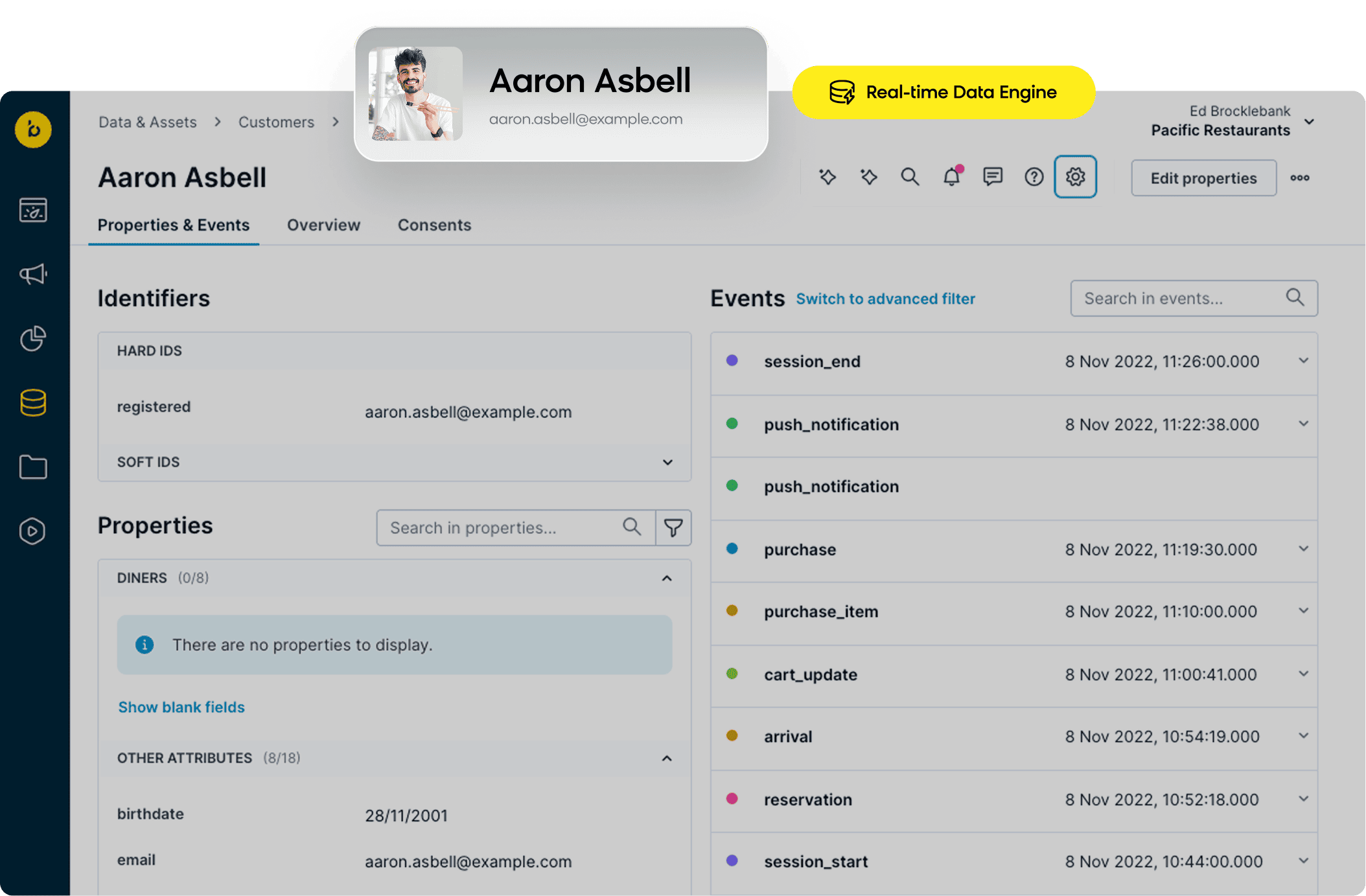

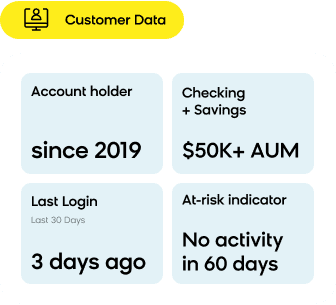

Customer Data

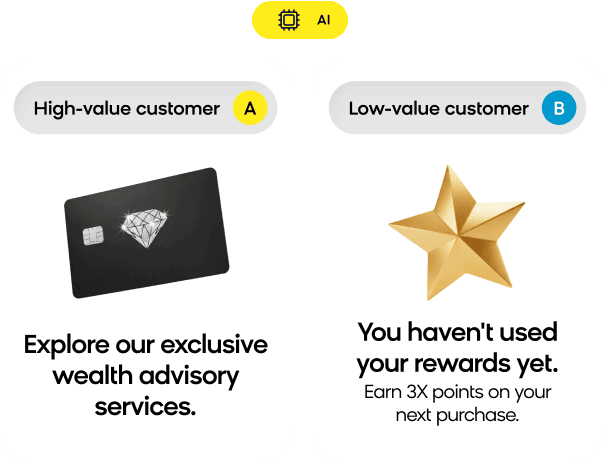

AI

Trusted by 1,400+ Brands Across Retail, FInANCE, Travel & Hospitality, and More

Why Personalization Feels Impossible in Finance — Until Now

Regulation, legacy systems, and competing pressures create a perfect storm. Finance marketers need to personalize to stay competitive and grow revenue. Here’s what’s really holding you back.

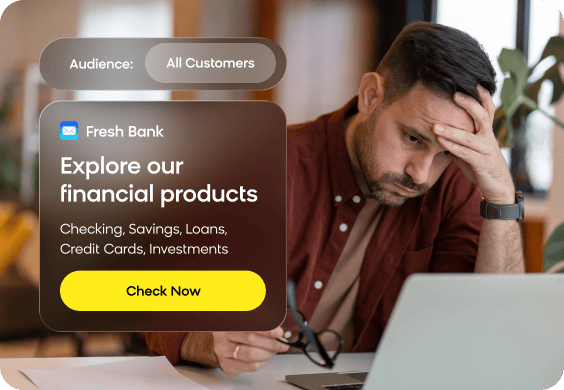

Every Email Feels Like a Risk

Customers expect offers based on their holdings and behavior. But using that data triggers compliance concerns. Result — you play it safe with generic messaging that underperforms.

Compliance Approvals Kill Speed and Creativity

Finance is heavily regulated (GDPR, CCPA, AML), so legal review gates every campaign. By the time compliance signs off, the moment has passed and your generic campaign launches weeks late.

Customer Data Across Many Systems

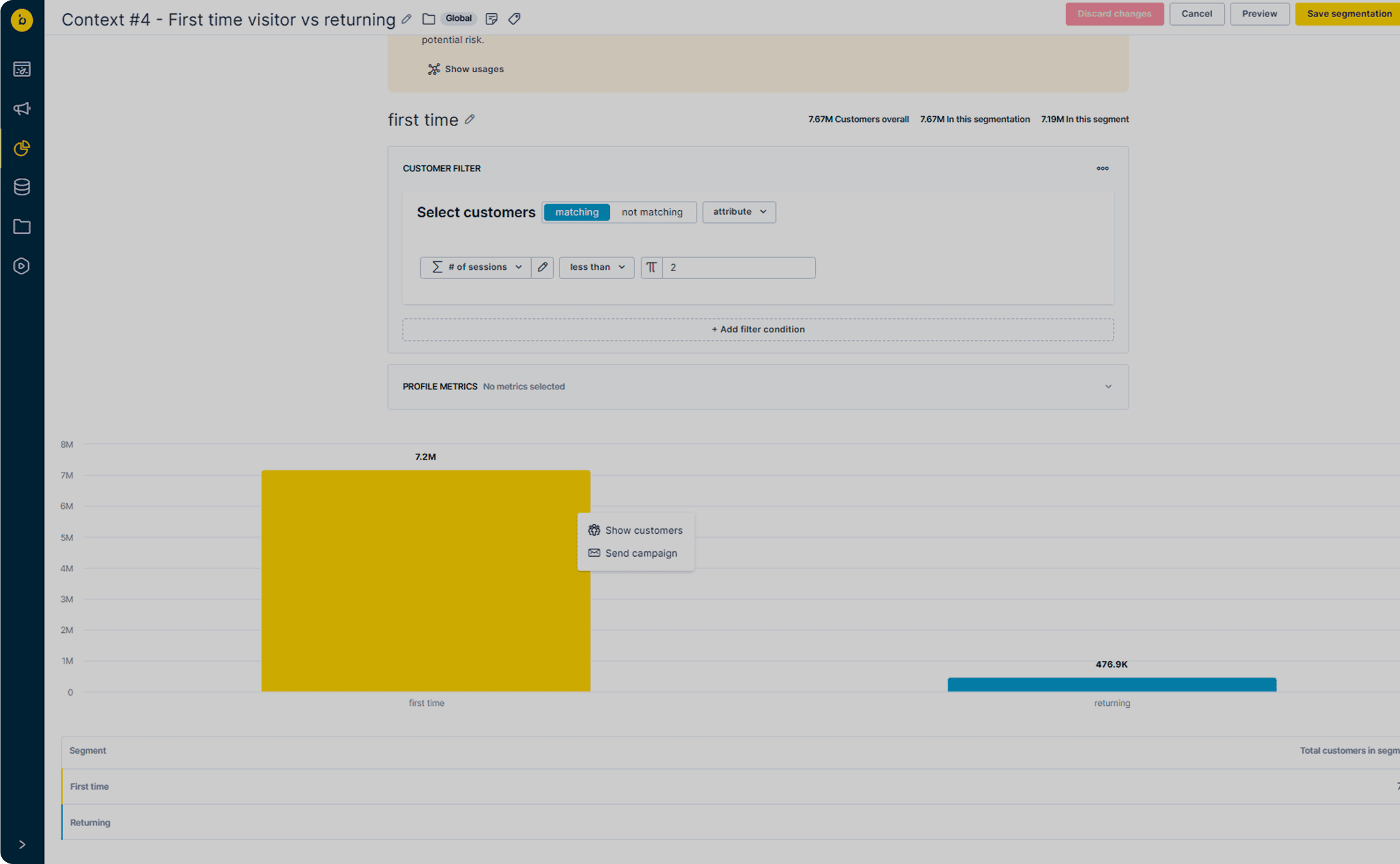

Account data in core banking, transactions in the warehouse, behavior in analytics, preferences in email. No single customer view means you can't segment meaningfully or act in real time.

FinTech Moves Fast. You Don't.

Finance is a highly saturated market. Nimble competitors launch personalized campaigns in days, while you're stuck with legacy tech and fragmented data. Identifying high-value customers and nurturing them effectively feels impossible.

Market Volatility Demands Real-Time Action

Rate changes and market volatility make customers anxious and eager to make decisions. Generic, delayed emails miss the moment when customers are actually paying attention.

Not quite your industry? Explore related ones.

Why Finance Brands

Choose Bloomreach

Use AI to sharpen targeting, strengthen cross-sell campaigns, and increase share of wallet across all your banking, lending, and investment services.

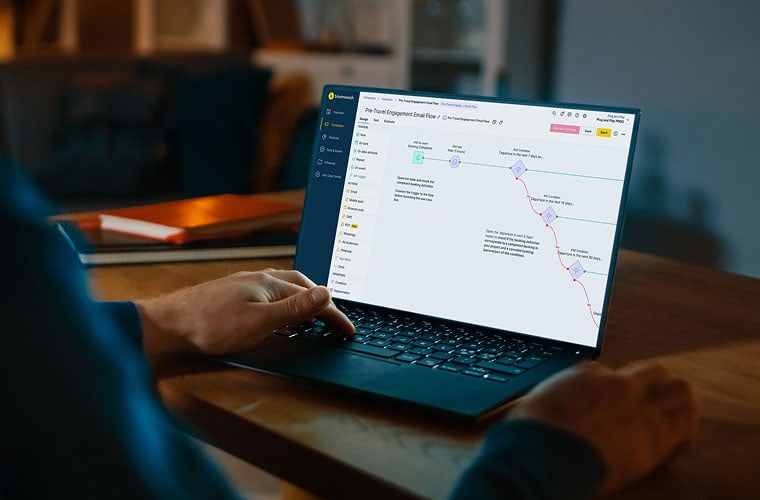

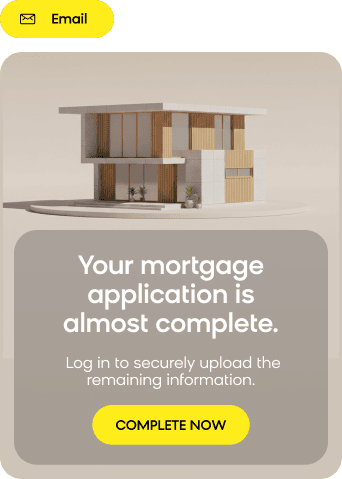

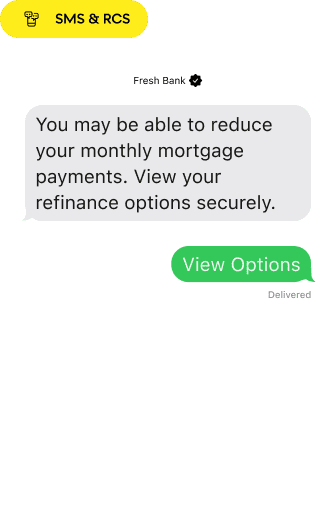

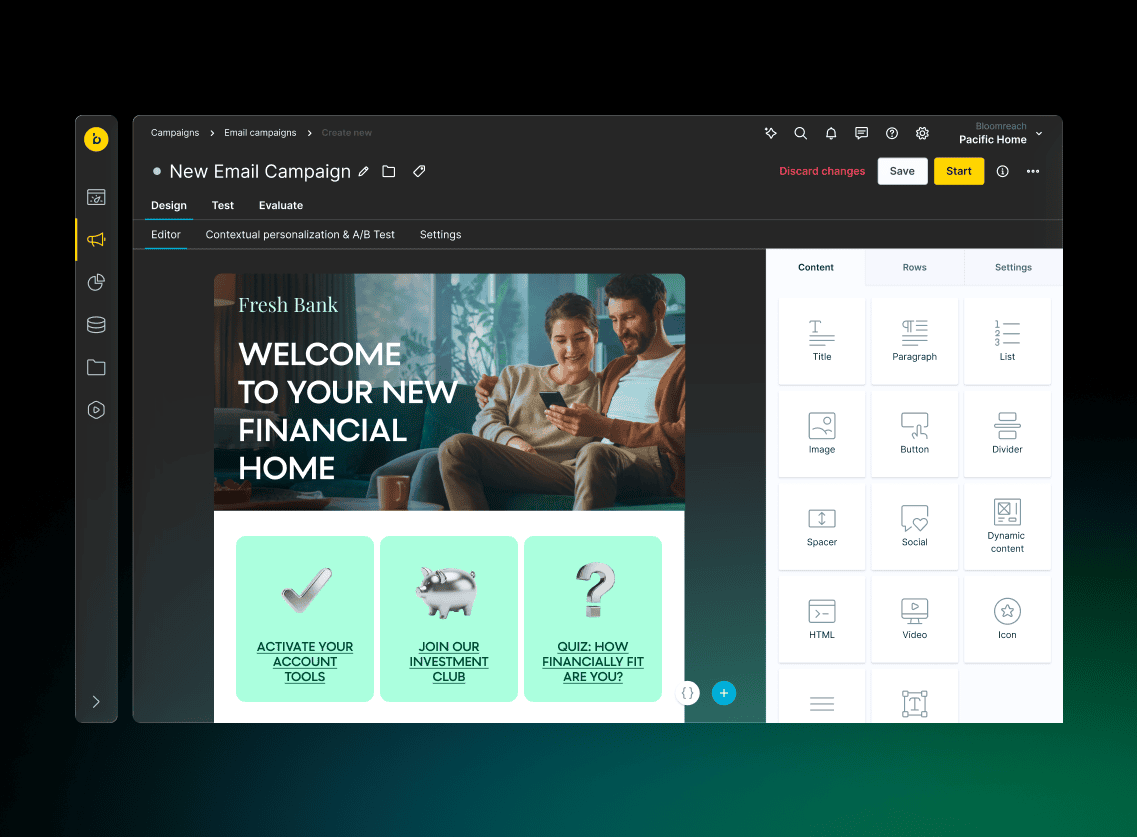

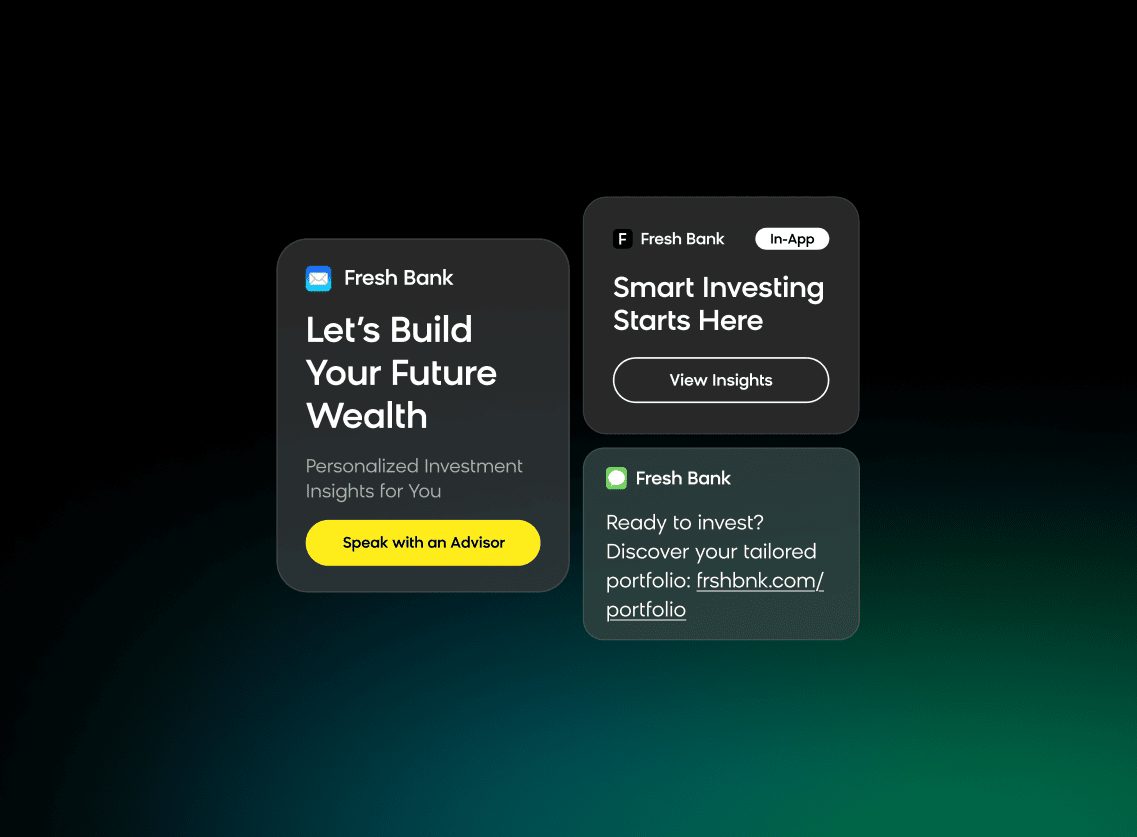

Stop sending generic batch emails. Bloomreach triggers personalized messages in real time — onboarding a new depositor, nudging a stalled loan application, or activating a credit card holder. Every email is relevant to where that customer is in their journey, compliant by design, and timed to convert.

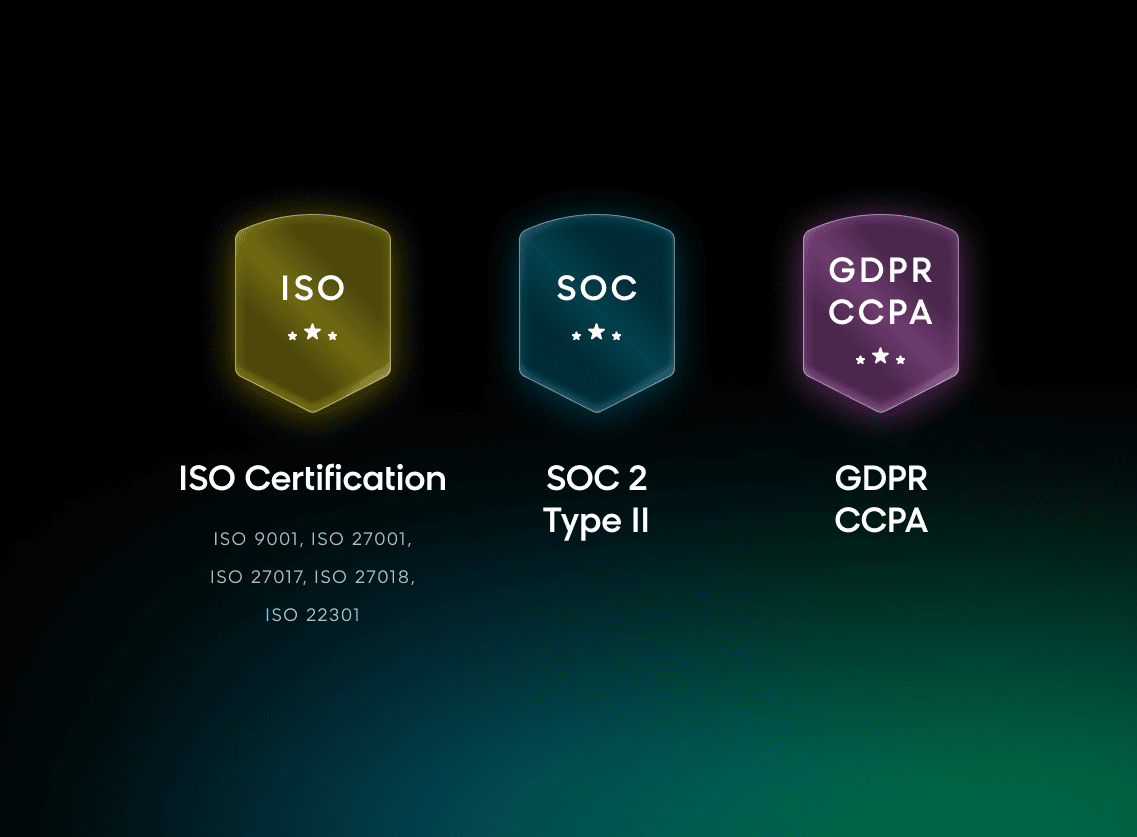

Being subject to strict rules and regulations shouldn’t limit your potential. Bloomreach has certifications such as SOC 2 Type II, ISO 9001, ISO 27001, ISO 27017, ISO 27018, and ISO 22301, ensuring your data is safe, secure, and compliant with global standards like GDPR and CCPA. Bloomreach’s robust consent management helps you build long-lasting, trust-based customer relationships securely.

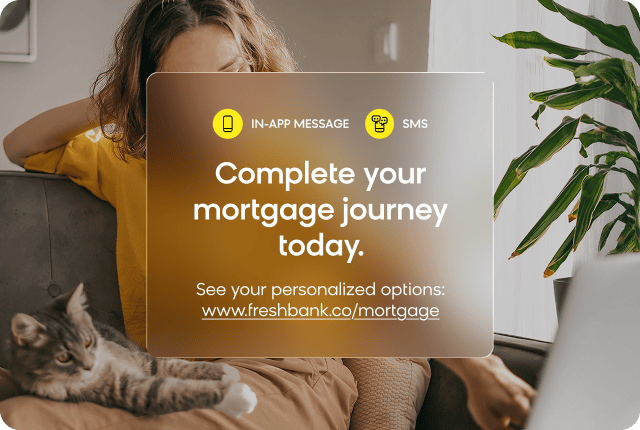

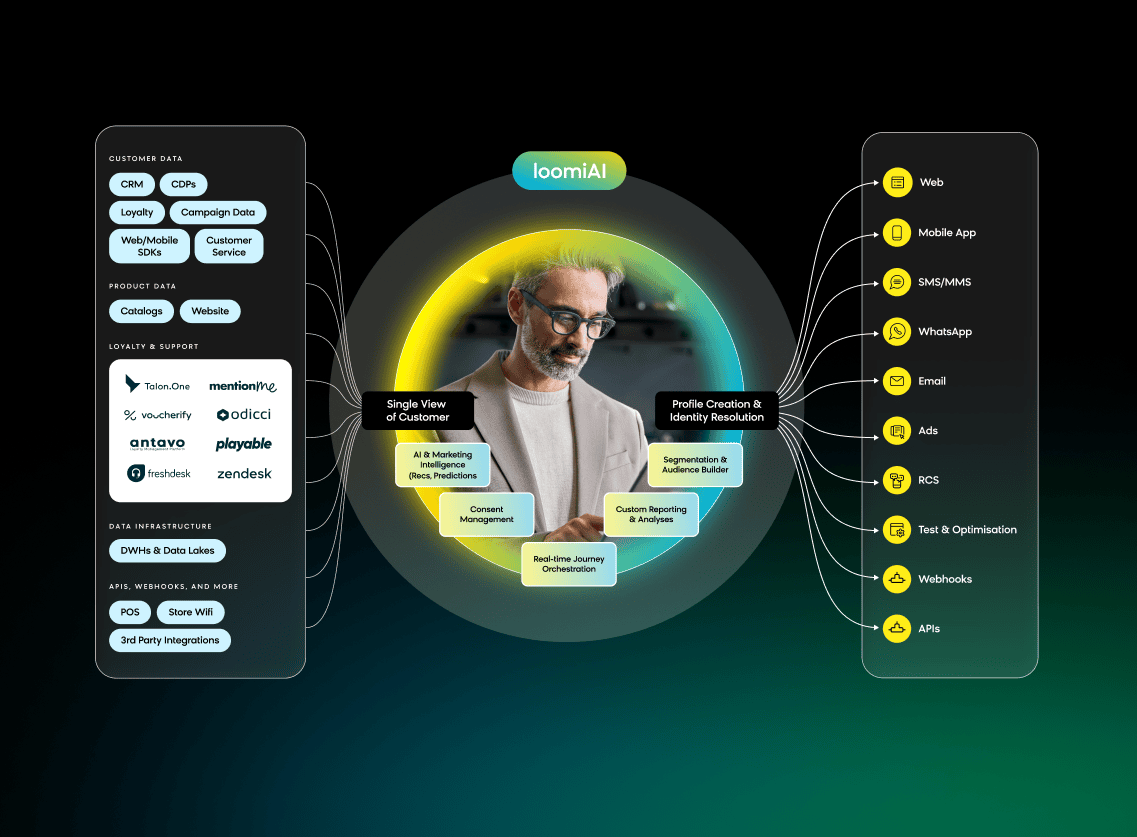

Unify all your client data in a single platform and unlock real-time personalization across 13+ channels. Accurate, omnichannel consent management enables you to micro-segment by life stage, product holdings, and risk signals. Identify cross-sell opportunities that actually convert while meeting the highest security and privacy requirements.

Deliver consistent, hyper-personalized messages across email, SMS, RCS, WhatsApp, push, web, and app messaging. Respect compliance and consent rules across every channel, so you can meet customers where they're most engaged without legal risk or manual workarounds.

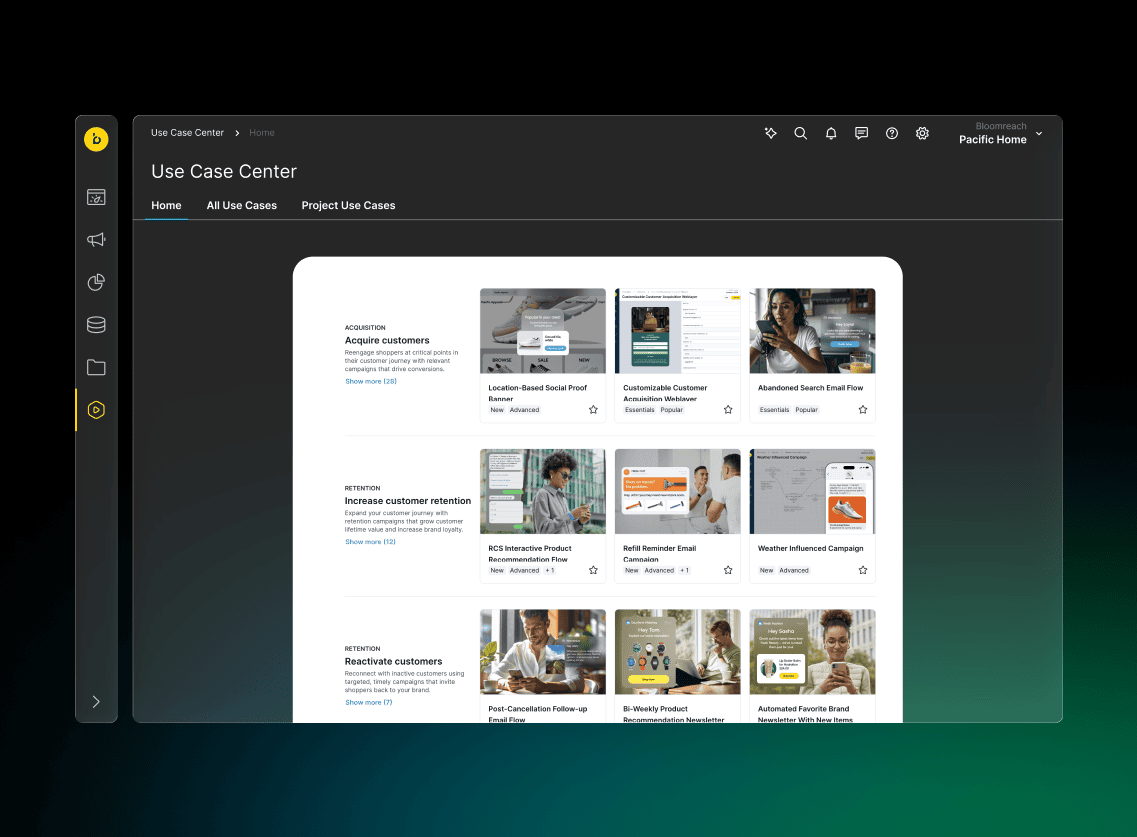

No more waiting for your IT teams to launch basic campaigns. With 100+ prebuilt use cases, drag-and-drop journeys, real-time segments, and predictive insights, teams execute 2x faster. Even better — consolidate tools, cut marketing costs and get expert guidance from your personal Bloomreach Customer Success Manager. Proven by both customer stories and analyst findings.

Smarter Marketing. Measurable Impact.

When your marketing is more personal, faster, and easier to execute—results follow.

+18%

Lift in Conversion Rate

thanks to the “interest rate increase auto alert”

Source: Raisin Case Study

2x

Faster Execution

Boost in marketing team productivity with less dependency on IT

Source: Forrester TEI Study

<6 mos.

Average time

to see ROI with personalized marketing

Source: Forrester TEI Study

Compliance limits what you say. It also demands you prove it.

Bloomreach automatically archives all customer communications across channels, meeting FINRA, FCA, SIPC, SEC, and ICO audit requirements so your team stays compliant without manual workarounds.

Finance Brands Grow Faster With Bloomreach. Here's How.

With Product Recommendations

“It is important for us to use our customer data in a meaningful way. Bloomreach Engagement helps us to increase our customer lifetime value and use our data to deliver personalized experiences across various channels.”

“Partnering with Bloomreach has been a game-changer for us. We have already accomplished so much, and we’re thrilled to expand into areas like next best action decisioning, digital personalization, and predictive modeling. It is a very exciting time for us.”

That Saves Time

“Before Bloomreach Content, marketers had to copy and paste content four times every time there was an update. Now, they make an update to one content document and can immediately publish it across all sites.”

“For the first time, we executed a complex policy transition initiative via Bloomreach instead of relying on branch offices. The results were excellent. This proved that digital-first approaches can drive both business outcomes and customer convenience.”

“Since integrating Snowflake with our Bloomreach account, we’ve seen a significant uplift in data quality, automation capabilities, and overall reliability across our campaign scenarios.”

With Product Recommendations

“It is important for us to use our customer data in a meaningful way. Bloomreach Engagement helps us to increase our customer lifetime value and use our data to deliver personalized experiences across various channels.”

“Partnering with Bloomreach has been a game-changer for us. We have already accomplished so much, and we’re thrilled to expand into areas like next best action decisioning, digital personalization, and predictive modeling. It is a very exciting time for us.”

That Saves Time

“Before Bloomreach Content, marketers had to copy and paste content four times every time there was an update. Now, they make an update to one content document and can immediately publish it across all sites.”

“For the first time, we executed a complex policy transition initiative via Bloomreach instead of relying on branch offices. The results were excellent. This proved that digital-first approaches can drive both business outcomes and customer convenience.”

“Since integrating Snowflake with our Bloomreach account, we’ve seen a significant uplift in data quality, automation capabilities, and overall reliability across our campaign scenarios.”

Frequently Asked Questions

Bloomreach's drag-and-drop email marketing solution excels for finance marketers because it automatically integrates with account data, transaction history, and customer lifecycle signals to create personalized recommendations within your email design. Our email builder includes elements like dynamic recommendations blocks, and AI-powered content that adapts to each customer's interests and buying patterns. This drives measurable results — financial services customers like Raisin achieve significant improvements in onboarding conversion rates, cross-sell revenue, and customer activation through real-time, compliant personalization.

Bloomreach combines real-time customer data, agentic AI, and omnichannel execution to help financial services brands build deeper relationships and grow revenue:

- Anticipate customer needs – Spot when someone is ready to open an account, apply for a loan, activate a credit card, or at risk of churning, then trigger the right message at the right time

- Maximize wallet share – Identify high-value customers for wealth management upsell, investment opportunities, or insurance cross-sell based on their holdings and life stage

- Recover at-risk customers – Bring back inactive depositors or lapsed cardholders with personalized win-back offers

- Build trust through compliance – Every message respects consent, regulatory requirements, and privacy — no compromises

- Scale efficiently – Small marketing teams can launch and optimize campaigns without IT bottlenecks, while AI agents test and improve journeys automatically

The result is not just a platform, but a strategic partner with playbooks, finance-specific expertise, and proven ROI.

Yes — and it's one of the reasons financial services brands choose us.

Bloomreach integrates seamlessly with your core banking platforms, data infrastructure, support platforms and marketing stack, including:

- Data warehouses (Snowflake, Databricks, Google BigQuery, Google Cloud Storage, Microsoft, Amazon Redshift, PostgreSQL)

- Analytics and BI tools (Tableau, Looker, Power BI, Typeform, QuantumMetric, Contentsquare)

- Customer Data Platforms (zapier, hightouch, tealium, Twilio Segment, metarouter)

- CRM platforms (Salesforce, HubSpot)

- Support (Freshdesk, Zendesk)

- Loyalty platforms (Talon.One, mentionme, antavo, voucherify, odicci, playable)

- Email and SMS providers

- Ad networks (Meta, Google Ads, TikTok, adform, Snap Inc and Criteo)

- Web and mobile apps (for real-time personalization)

Browse all our integrations.

Most financial services brands launch their first personalized journeys within weeks. Thanks to pre-built templates, native integrations, and fast onboarding, you can start seeing results quickly.

For example, finance marketers can start fast with templated flows they can customize:

- New account onboarding sequences that activate customers

- Loan application nurture flows with abandonment recovery

- Credit card activation campaigns with first-purchase nudges and rewards enrollment

- Cross-sell journeys matching customers to wealth, investment, or insurance products

- Win-back campaigns for inactive customers

- Economic event-triggered messaging (interest rate changes, market volatility alerts)

Yes. We capture behavior pre-login (as long as the user accepts the cookies) and merge it when identities resolve, enabling relevant outreach and on-site experiences early in the journey.

We capture and manage consent preferences, respect channel restrictions, and maintain audit trails for every message. Personalization and compliance work together, not against each other.

Security and compliance are built into Bloomreach's foundation, not added as an afterthought. We hold the certifications financial services regulators expect:

- SOC 2 Type II – Independent audit of security, availability, and confidentiality controls

- ISO 27001/27017/27018 – Information security management and cloud security standards

- ISO 9001 – Quality management systems

- ISO 22301 – Business continuity and disaster recovery

- GDPR and CCPA – Privacy frameworks built into data handling and consent management

We also provide native consent and preference management, so every customer interaction is ready for audit. Your data is encrypted, your compliance team has visibility, and you can personalize without legal risk.

For detailed security information, see our Security & Compliance documentation.

Not daily. Our platform is built for marketers and merchandisers to run campaigns independently. Of course, we’ll work with your tech team during setup to make sure everything integrates smoothly.

Yes. Bloomreach supports localized multi-language content, currencies, and customer segments, so you can manage campaigns across markets from one platform.

You don’t just get software — you get a strategic partner.

From day one, you’ll work with a dedicated team of Bloomreach experts to get up and running fast and grow with confidence. Here’s what support looks like in practice:

- Dedicated onboarding team: We guide you through setup, integrations, and launch — typical implementations take 10–12 weeks, but campaigns often go live earlier.

- Ongoing customer success: After go-live, your Customer Success Manager stays involved, helping you prioritize use cases, spot growth opportunities, and stay aligned with your goals.

- Plug & Play use case library: Dozens of pre-built, travel-specific campaign blueprints help you launch fast and iterate confidently.

- Bloomreach Academy: Access live and on-demand training, certifications, and hands-on workshops — designed for marketers, not developers.

- 2-minute support response time: Our support team (many are former consultants) knows the platform inside-out and is ready when you need them.

- Strategic roadmap input: 70–80% of product features are driven by our customers. Your feedback isn’t just welcome — it shapes what we build next.

A 30-Minute Chat To Help You Make Sense of It All

01

Let’s talk about your current setup and the reasons you’re exploring new options.

02

Gain a clearer understanding of the product landscape and your available choices.

03

We’ll share our perspective on how Engagement stacks up against the competition.