Customer acquisition cost (CAC) is one of those metrics that every marketer knows is an essential statistic, but not everyone fully understands.

Despite it being an important barometer of your company’s success, it gets neglected in many businesses’ strategic planning and is often confused for cost per acquisition (CPA).

Considering how important these metrics are to the health of your company, mixing them up can result in an entirely preventable failure.

Here’s everything you need to know about customer acquisition cost — how to calculate it, how it differs from cost per acquisition, and how to improve your CAC to boost your business’ bottom line.

What Is Customer Acquisition Cost and How Do You Calculate It?

Customer acquisition costs measure the total cost of your sales and marketing efforts to earn a new customer in a specific time period.

The equation to find your CAC is a straightforward one: Divide all the costs spent on acquiring new customers (e.g., sales and marketing expenses) by the number of customers acquired in the same time period.

For example, if a company spent $1,000 on sales and marketing in a year and acquired 100 customers in the same year, their customer acquisition cost is $10.

What is a Good Customer Acquisition Cost?

A good customer acquisition cost can vary significantly depending on the industry, business model, and company size. Generally, a good CAC is one that is lower than the lifetime value of a customer, ensuring that the business is profitable over time.

Here are some general guidelines:

- Industry Standards: Different industries have different benchmarks. For example, SaaS companies might have a higher CAC due to the nature of their business, while ecommerce companies may have a lower CAC.

- LTV to CAC Ratio: A common rule of thumb is to aim for an LTV to CAC ratio of 3:1. This means that the lifetime value of a customer should be at least three times the cost of acquiring them.

- Efficiency: A lower CAC indicates more efficient marketing and sales processes. Companies should continuously optimize their strategies to reduce CAC while maintaining or increasing LTV.

- Growth Stage: Startups might have a higher CAC initially as they invest in brand awareness and market penetration, but this should decrease as the company grows and gains more organic traction.

Ultimately, a “good” CAC is one that aligns with your business goals, ensures profitability, and supports sustainable growth.

What is an Average CAC in Retail?

The average CAC in retail can vary based on the channel used. According to Shopify, here are some typical figures:

- SEO: Approximately $30.33

- Email Marketing: Around $15.92

- Influencer Partnerships: About $73.58

- Online Paid Ads: Roughly $59.17

These numbers can fluctuate depending on the specific retail sector and marketing strategies employed.

How Is Cost Per Acquisition Different from Customer Acquisition Cost in Marketing?

CAC and CPA are very similar and useful metrics, but there is one key difference: CAC measures the cost to acquire a paying customer, while CPA measures the cost to acquire a lead — for example, a registration, activated user, or a sign-up for a free trial.

Because customer acquisition cost measures the cost of converting a customer, it can encompass all types of marketing channels. It is a metric that can be applied to your business as a whole, giving you a big-picture view of your relationship with the average paying customer as opposed to a campaign-specific view.

But not all customer acquisitions are the same. Acquiring customers doesn’t begin and end with clicking a purchase button — some businesses have short paths to purchase while some lead times take months or years.

Different companies cater to different audiences, use different campaigns, and utilize different ways to guide customers through the customer lifecycle. To understand these nuances, metrics like cost per acquisition are incredibly helpful.

Read This Next: What Is Customer Lifecycle Marketing?

This is because cost per acquisition is more of a campaign-level metric. CPA looks at the cost to acquire a lead (not yet a paying customer) who took an action that you wanted them to take, like downloading an e-book, submitting a demo request,or any other submission of contact information with intent.

Since cost per acquisition measures conversion goals, which aren’t necessarily purchases and can vary from campaign to campaign, calculating one CPA for your overall business is a difficult task. There are very different factors and costs to converting Facebook ads, email campaigns, and SMS campaigns.

That’s why CPA is traditionally used to measure the specific cost/profit ratio of particular marketing channels, and the varying factors for each channel make each calculation its own unique equation.

For context, here are some simple ways to understand the difference between CAC and CPA:

CAC vs. CPA Examples

- If you sign up for a free month of Netflix, you’re measured using CPA. Once you pay for the first month after your trial, you’re measured using CAC.

- If you’re a Facebook user, you’re measured using CPA. If you’re a Facebook advertiser, you’re measured using CAC.

- If you make an account on an ecommerce site without purchasing, you could be measured with CPA. Once you’ve made a purchase, you’re measured with CAC.

What is a Good Cost Per Acquisition Ratio?

A good cost per acquisition (CPA) ratio is typically determined by comparing it to the LTV of a customer. Here are some general guidelines:

- LTV to CPA Ratio: A common benchmark is to aim for an LTV to CPA ratio of at least 3:1. This means that the revenue generated from a customer over their lifetime should be at least three times the cost of acquiring them.

- Profitability: Ensure that the CPA is low enough to maintain profitability. If the CPA is too high, it can erode profit margins.

- Industry Standards: Different industries have different acceptable CPA levels. It’s important to compare your CPA with industry averages to gauge competitiveness.

- Business Goals: Align your CPA with your business objectives, whether it’s growth, market penetration, or maintaining a steady customer base.

Ultimately, a good CPA ratio supports sustainable growth and profitability while aligning with your business strategy.

Why Does Customer Acquisition Cost Matter?

If you run an ecommerce business, your customer acquisition cost is a crucial statistic. Calculating, understanding, and optimizing your CAC should be a top priority.

Cost per acquisition has its place and measuring each channel’s CPA can shed light on important aspects of your CAC, but your marketing strategy won’t get far without a strong grasp of your customer acquisition cost.

Calculating your CAC is similar to checking the pulse of your business. Measuring how much your business is spending to acquire customers can determine the vital next steps for your company, whether that means optimizing your customer lifetime value (LTV) or completely reassessing the cost/profit ratio of your business as a whole.

This is especially true in relation to your LTV, a measure of a customer’s monetary value to a company over a period of time.

The balance between your CAC to LTV is one of the most important relationships a business needs to keep under control — it’s no exaggeration that this relationship will tell you whether or not your business can succeed.

Read This Next: The Ultimate Guide to Customer Lifetime Value

Luckily, this correlation between CAC and LTV is easy to comprehend.

Simply put, if you want to know if your ecommerce business is in good shape, your customer acquisition cost needs to be lower than your customer lifetime value.

This ratio lets you know how much your business can spend to acquire enough customers without spending more than the value those customers will bring to your company.

Let’s take a look at how you can implement these ideas in your marketing tactics and how these calculations work in practice.

Examples of Customer Acquisition Cost Analysis

First, let’s see how customer lifetime value and customer acquisition cost work together to illustrate the health of your business.

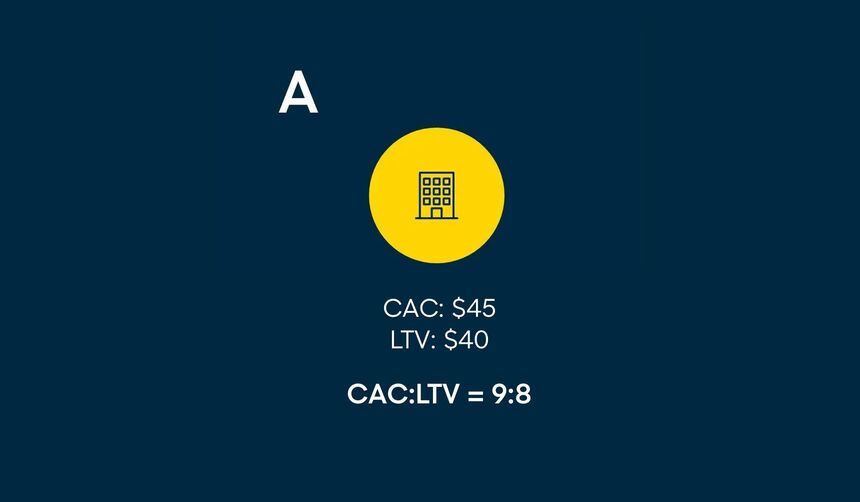

Consider Company A, for example. Company A’s LTV is $40, and its CAC is $45.

With a customer acquisition cost that is greater than its customer lifetime value, Company A is doomed to fail. Even if the company becomes one of the most popular brands in the world, it can’t sustain a business model where the cost to acquire a customer is greater than the value they offer.

This may seem obvious, but many ecommerce companies haven’t taken the time to calculate these metrics and understand the repercussions for their business. They may be paying more than they can possibly make back, without even knowing it.

It’s also important to know how much higher your LTV is than your CAC, as it will inform how quickly your company’s revenue will grow.

Let’s compare the metrics of two more example companies, Company B and Company C.

- Company B’s LTV is $40, while Company C’s LTV is $400

- Company B spends $10 to acquire a customer, while Company C spends $200

Even though Company C makes $200 per customer and Company B makes $30, the CAC to LTV ratio shows that Company B will be able to scale twice as quickly. It costs less per customer to get more value, making their business model much more sustainable with the ability to grow revenue faster.

You can also use this ratio to examine paying customers within individual channels and campaigns. If you calculate the customer acquisition cost for each of your separate marketing channels, you’ll know which of these bring you the more affordable customers. Combine that with your LTV, and you’ll know which channel brings you the most valuable customers overall.

How To Improve Customer Acquisition Cost

If you’re looking to lower your CAC, it can be hard to know where to start.

Is the cost of your marketing a problem? Are you paying too much to bring a visitor to your site? Or is the issue that you just aren’t converting enough of them?

Customer acquisition cost is a metric that deals with the full scope of your business, so drilling down on a few key areas and addressing these kinds of questions is the best way to make a big impact.

Here are a few key ideas to consider.

How To Lower Your Marketing Costs

If converting customers isn’t an issue for your business, but it’s costing too much to bring them to your site, here are a few ideas to bring your costs down:

Identify Your Best Acquisition Channels

Zeroing in on your best-performing channels and optimizing them for acquisitions can go a long way towards driving down your customer acquisition cost. Here’s a simple process to determine which channels are worth focusing on:

- Track the number of visitors coming in from each channel. You need to know how many customers are coming from each marketing channel to fully understand your efforts.

- Divide the marketing spend for each channel by the number of visitors gained. Using this equation, you can determine which channel brings you the cheapest traffic and which is the most expensive.

- Focus your energy and budget on what works. With a ranking of your most costly and most affordable channels, you can start optimizing them and getting the most out of your spending.

Identify Your Best Campaigns

Just like your channels, you can pinpoint your most lucrative campaigns and use them as blueprints for a more optimized campaign strategy.

- Divide the cost of each campaign by the number of visitors gained. This will tell you your best acquisition campaigns. Which campaigns are the most cost effective? Once you identify the best performers, you can replicate them for the best results.

- Divide the cost of each campaign by the number of customers retained. This will tell you your best retention campaigns. Focus your time and budget on the ones that are most cost effective.

Identify Your Target Audience

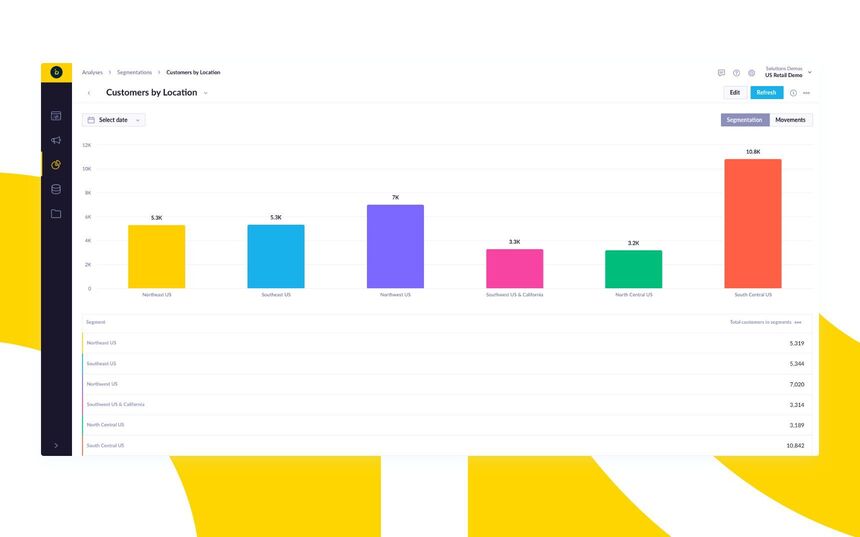

Truly knowing your customers is the best way to improve your targeting techniques. Understanding and connecting their behaviors, wants, and segments can both grow and streamline your efforts.

- Lean into lookalike audiences. Use the purchase predictions of your current users to create a Facebook or Google audience for a remarketing campaign.

- Segment your customers by their customer lifetime value. For your retention campaigns, make sure that targeted efforts for high-value customers have the most budget behind them, and that you aren’t spending too much to retain low-value segments.

Read This Next: Customer Segmentation: Options Marketers Should Know

Optimize Your Ad Spending

It’s important to make sure your ad spending is always aimed at customer acquisition. Here are a few key steps you can take:

- Make sure your spending isn’t going towards the wrong audience. Use negative audience segmentation to ensure no ads are wasted on an audience unlikely to convert.

- Don’t waste your spending with repeated efforts. Use ad frequency capping to limit the number of times a visitor will be shown an ad.

- Support your ads with ecommerce best practices. Attract organic traffic through SEO, unique product descriptions, and other ecommerce optimization strategies to reduce dependence on paid traffic.

Improving Your Conversion Costs

What if you’re getting a good amount of traffic, but none of it is converting once you get your target audience on site? Here are a few ideas to help you lower your conversion costs:

Optimize Your Customer Journey

- Analyze your traffic and campaigns to see where you’re losing customers. Which stages or steps in the buying process see the most drop off?

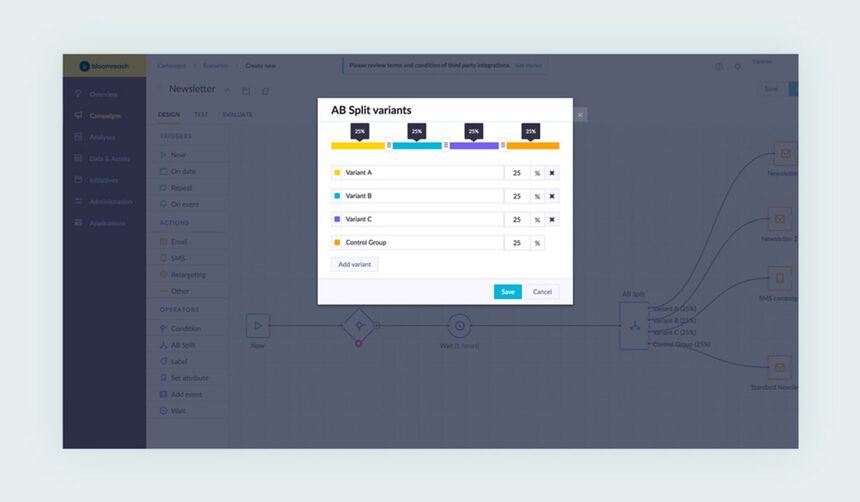

- A/B test different variations of your customer experience based on your analysis. Once you know where you are leaking customers, you can orchestrate your ideal customer journey.

Cater to Returning Visitors

Personalize your site to include recommended content. Inspire users revisiting your site with recommendations based around previous browsing history.

- Deploy banners to returning visitors. Make your recommended products front and center in their site experience.

- Display banners to returning visitors who have an abandoned cart. Remind them of the items in their cart and entice them to complete their purchase.

- Send personalized email offers based on their browsing history. A personalized email marketing strategy can bring customers back onsite and inspire a purchase.

Optimize Your Site’s User Experience

- A/B test multiple variants of website modifications. You can test and refine every aspect of your site experience until you find what performs best, whether that means simplifying your entire homepage or testing the difference between a red, blue, or green CTA button.

- Minimize any distractions around your point of sale. Don’t let a busy UX stand in the way of conversions. Your product pages should essentially be landing pages leading to the completion of a transaction.

Optimize Your Customer Acquisition Cost With Bloomreach Engagement

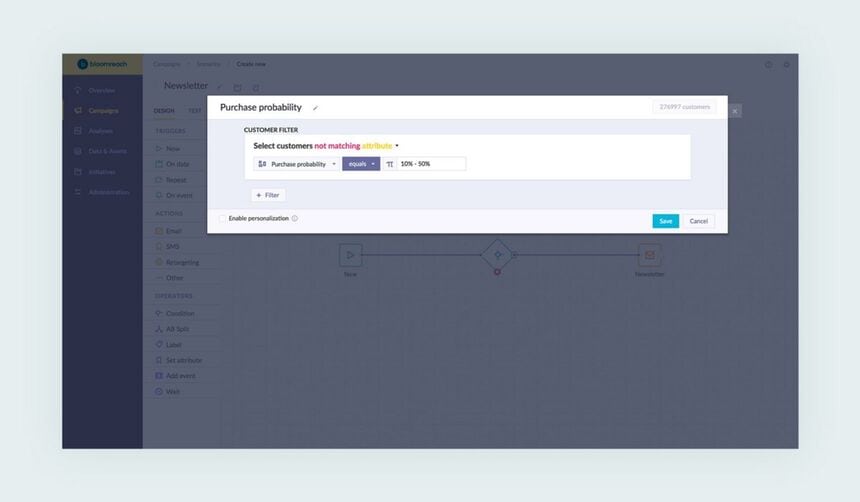

To truly optimize your customer acquisition cost and set your business up for success, you need all the right information and tools at your disposal. It requires access to real-time data with a connected marketing tech stack to put all your insights into action.

That’s exactly what Bloomreach Engagement offers. Our solution has all the key components you need to calculate your customer acquisition cost, optimize it with informed and integrated marketing efforts, and so much more.

Bloomreach Engagement is an all-in-one platform that helps marketers create personalized campaigns for every customer. It combines the power of a customer data platform with the speed and scale of AI, helping you reach customers where and when it matters most.

It’s designed to impact every phase of your customer journey, providing a single marketing view of real-time customer data, campaign automation across 13 channels, and analytics that make it easy to grow your brand and your revenue — fast.

If you’re ready to activate your data and need a method for calculating CAC, check out our CAC and LTV Calculator to take the next steps in making sure your business is aligned to where it should be with CAC. Our calculator can help you accurately calculate customer acquisition cost and take your customer relationship management to the next level.