Since COVID-19 began to have it’s impact in the west in late-February and early-March we have been living through an accelerated pivot in how our lives are lived and business is done. Everything has changed – from our daily routines to education, from our entertainment to how we work, from our shopping habits to our spending patterns.

And of course, just as it appeared we were beginning to gain control over the virus and moving into the next phase of opening the economy back up, the terrible tragedy of George Floyd’s murder in Minneapolis triggered mass demonstrations across the United States – as well as a number of cities in the U.K. and Europe – demanding racial equality and an end to police and other targeted violence toward Black Americans. This adds to a sense of unease in many cities and communities that have already been dealing with the impact of the virus.

We do not yet know the implications of those protests and demonstrations on virus transmission and the possibilities of a second wave of COVID-19, but we already see that transmission rates are the U.S. daily rates climbing again with more than 20,000 new cases a day – as the continued improvement in a number of regions is offset by new outbreaks in the South and parts of the West.

It seems we are still far away from a ‘new normal’, and the upcoming 2020 presidential election – as well as state and local elections – in the United States will aggravate a sense of unease, increase the likelihood of more collective action and rallies across the political spectrum, and may prolong the a return to to pre-COVID life.

For businesses this all has deep implications on strategy, with a combination of key factors impacting the mid to longer-term. Of course in the near-term the virus is the big variable, and we still have no idea how this plays out. While we tiptoe out our doors as governments ease restrictions in phases, the truth is that the kinds of interactions and environments we were accustomed to are simply not going to be the same.

Masks, social distancing, and constant disinfection are going to make venturing out very unappealing until a vaccine is available or ‘herd-immunity’ is attained. A vaccine is likely not available in large quantities until Q1 2021 at the earliest, and even then availability across the population is not a certainty even then.

This means ‘social distancing’ will remain ‘a thing’ with large segments of the population wary about a return to pre-COVID behaviors even if local governments feel pressure to open up. This of course has significant implications for businesses that rely on large and intimate gatherings alike – from retail, to travel, to entertainment, to dining and food service, to manufacturing. The very patterns of our lives are changing – likely for a long time. Many of the habits we are forming now, will persist indefinitely.

This means that the economic conditions we see today will not quickly improve. The overall economy today is profoundly awful. Even with a positive jobs report in the U.S. this week, we are behind by tens of thousands of jobs from where we were, with a jobless rate of 13.3%. U.S. consumer spending, the U.S. economy’s main engine, fell by a record 13.6% in April, the steepest decline back to 1959. We do not yet have May numbers, but it is likely similar.

Ironically, American personal income, which includes wages, interest and dividends, increased 10.5% in April. That jump reflects a sharp rise in U.S. federal and state government payments through federal rescue programs, primarily one-time household stimulus payments of $1,200, as well as the so called ‘unemployment+’, the bump in unemployment for U.S. workers recently laid-off which in some cases has increased income for these workers.

That is not the case in the U.K. and Europe, where governments took a different strategy toward employment security, and only time will tell if that has a better long-term impact or not. We are expecting, by various estimates, at a 30% shrinkage in GDP in Q2 in the U.S., and thirty percent seems fairly optimistic by many standards. A recovery will hopefully begin to be evident in Q3 2020, but it will likely take quite some time to play out – by some estimates it may take up to a decade to recover.

As The Economist reported, the severity of lockdowns and their effect on the economy may lower global GDP reduction in the range of -10%. This has significant downstream implications, as consumers and businesses alike cut back on consumption or lack the ability or confidence to spend and invest. The “90% economy” will be both smaller than that which came before, but will also have profoundly different winners and losers than we had before.

This will be exacerbated as the very foundation of the economy changes profoundly. City centers, suburban office parks, and malls will empty out, or at the very least feel very different. Remote work and social distancing are going to lead to some very real changes in our cities and routines that drove major parts of the economy. Commutes will decrease, and ‘running by the store’ at lunch on the way home will be a thing of the past for many. In fact, many may opt for a less dense rural or ex-urb lifestyle where they have more room – and they now rarely need to venture into the city or get to the airport. Meetings, education and business can now be online – the ‘zoomification’ of our lives – even if it has mixed results and does not work for everyone. If even 20% of pre-COVID work moves to ‘remote’ and ‘virtual’ this will have profound impacts, and I suspect it will be greater than that.

As a result, our dense urban, exciting areas that attracted office workers and loft-livers who ate out 75% of the time as they navigated the latest hot spots for fusion burritos, gelato, and hot-yoga studios as they biked, walked, or took mass-transit – ya, not so much. The retailers and businesses that served them are already pivoting to digital with a mix of omni-channel. Larger merchants will have the advantage, but there is opportunity for many to participate. Much of this is also true for suburban malls, though we will see ongoing development of curbside pick-up and buy-online-pick-up-in-store (BOPIS) as a common, welcome customer experience.

And of course, business and leisure travel will be significantly cut, with destination shopping and entertainment locations suffering significant reductions in foot-fall – such as Manhattan, London, Paris, Milan, Chicago, Las Vegas, and city centers everywhere. The ‘experience economy’ will be hit significantly, though that spending may shift to other areas such as the home and kitchen, the garden, pets, online entertainment including gaming, and outdoor recreation.

The implications on businesses of all kinds is profound, but we must face the reality across business segments. In time we may see a return to pre-COVID ways of life. We at Bloomreach – together with our partners from Accenture, WPP, Mindcurv, and Diva-e – commissioned a comprehensive study called “The State of Commerce Experience” conducted by Forrester that looked into the current state of digital and eCommerce. This research allowed us to look at pre-COVID behaviors and sentiments as well as how those were changing as COVID led to ‘stay-at-home’ quarantines. We looked at both retail and B2C, but also B2B – across the U.S., U.K., and DACH region.

There is a lot to learn from this research, but some key findings include:

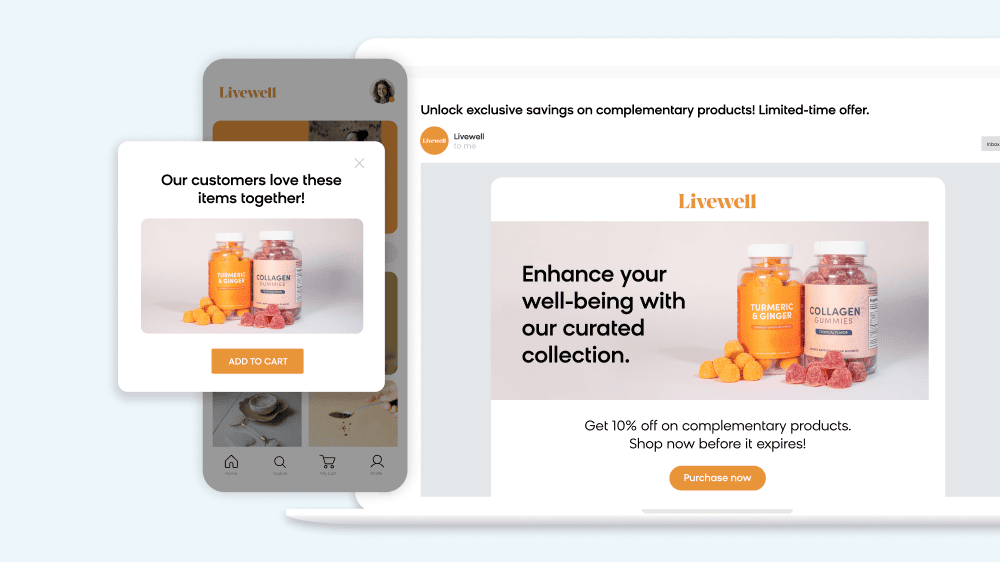

- Digital commerce is front and center for both consumers and B2B buyers. The coronavirus pandemic has driven half of shoppers to buy products they’ve never bought online before – which is astounding for a mature channel – and 70% of them are buying more than usual online*.

In North America, eCommerce for Bloomreach customers +49.79% year-over-year (YoY) in May 2020, and up in the United Kingdom and Europe eCommerce traffic was +22.48% with sales only +9.76% YoY – much of the gap attributable to lower average order sizes due to heavy promotional activity. In fact, almost half of businesses report digital commerce driving growth during the pandemic as they see an uptick in online search, traffic, and orders.

And while essential products dominated early in the ‘stay-at-home’ period, that is no longer the case – consumers and B2B buyers are spending online across many categories. Companies can no longer downplay the critical importance of digital commerce and investment now will set companies up to survive and thrive in the near and longer-term.

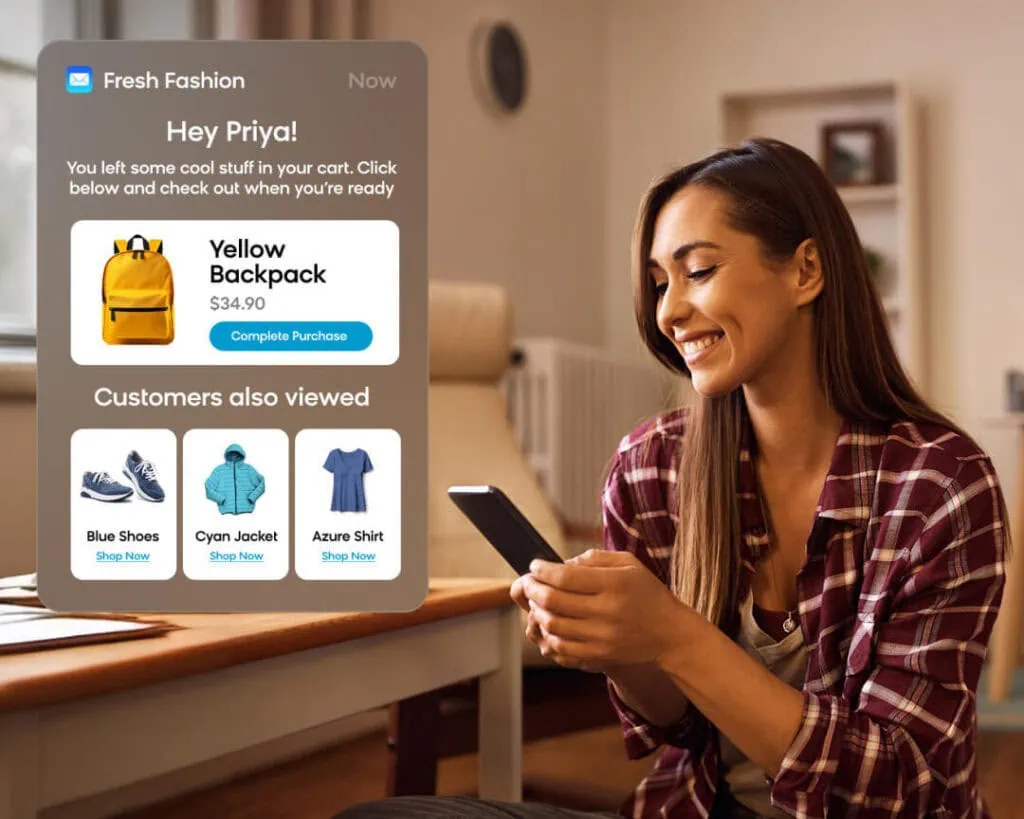

- Customers will pay for a better commerce experience, but businesses struggle to provide essential must-haves. Customers say they prefer online channels for researching, buying, and finding inspiration, and nearly 40% of consumers and a surprising 56% of B2B customers say they would pay more for a better experience. And, adding to the high-stakes, they will not buy from the same business again if they have a bad experience.

The research also found that too many businesses today don’t provide the basic table-stakes of effective digital commerce like easy website navigation, relevant search results, and clear, rich product information – let alone excel in delivering inspiring experiences that connect with and inspire their customers. eCommerce is no longer simply a transactional channel, it is an emotional one.

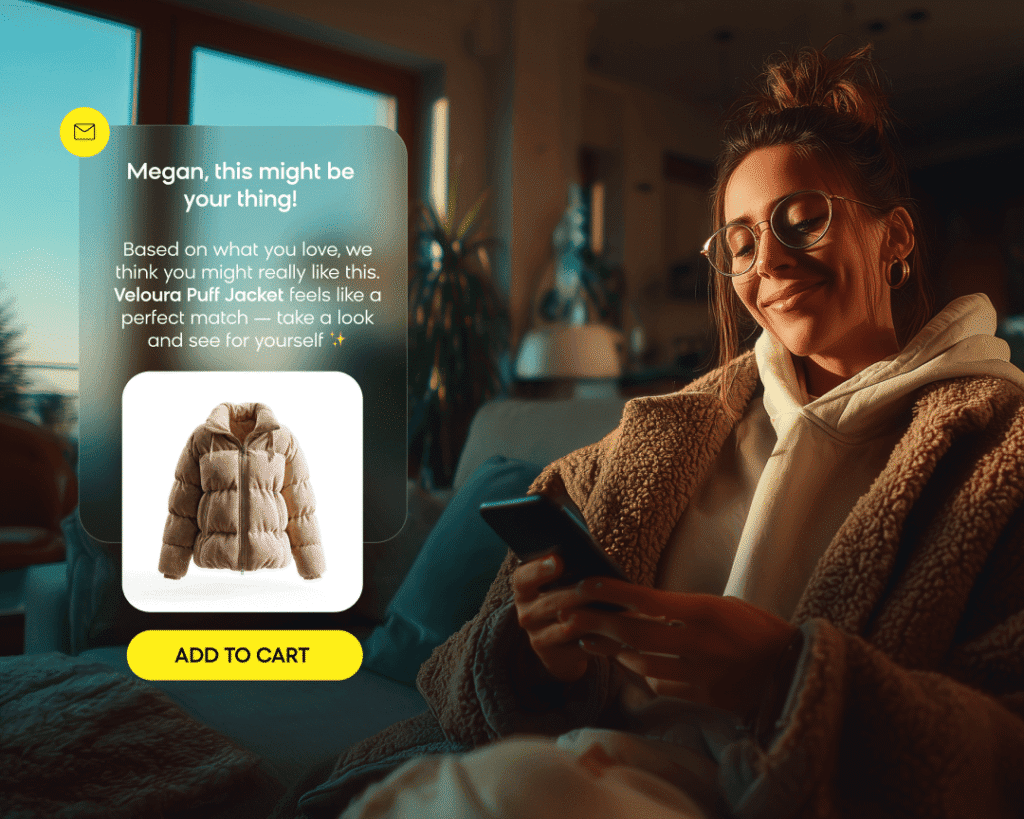

- The good news is that in response, businesses are looking to increase investments in core digital commerce technologies that enable great experiences. Businesses are shifting spend from offline to online, with half of businesses cutting investment in their physical stores (and in B2B, traditional sales channels) and increasing it in online channels like web, apps, social, and third-party marketplaces.

Most business leaders we surveyed also plan to increase investment in eCommerce customer experience (CX) technology such as personalization, search, and content management, as well as modernizing their eCommerce platforms. This is a good sign, but it is imperative that senior leadership and boards at these companies get behind this now.

These findings and many more are reflected in “The State of Commerce Experience” and I strongly encourage you to check that out and also consider attending upcoming events where Forrester analysts behind this great research will join us in understanding what it means for businesses today – including yours.

The time for businesses to lean in and understand the implications of this tectonic shift in customer behavior and the economy is now. To not do so is going to destroy value and put business at risk in the short-term, and have profound longer-term implications as well. Trying to win the race from a lap down is not an effective strategy.

Thank you. Be well, be safe, and here is to good business.

—

Much of the above research is from “The State of Commerce Experience”, A commissioned study conducted by Forrester Consulting on behalf of Bloomreach, April 2020

Also cited is Bloomreach’s Commerce Pulse data and reports. Bloomreach powers 25% of US & UK eCommerce search and commerce experiences across the 300+ global enterprise businesses – many of whom have multiple brands and eCommerce sites. You can find all of Bloomreach’s Coronavirus related research, including previous weeks, on our Coronavirus Content Hub. We also host monthly calls where we share data from previous months, you can register here.