The impact of the COVID-19 vaccine has been wide-reaching and significant for those who can access it. Like any other major world event or trend, the vaccine will affect digital commerce as well.

The grocery sector boomed in 2020 when worldwide lockdowns went into effect. When people could no longer dine-in at their favorite restaurants and grocery shopping as it has been done for decades no longer felt safe, they had to replace those meals somewhere and many did it with online grocery shopping. That resulted in a significant 92.66% year-over-year sales increase in online grocery sales for Bloomreach grocery-segment customers. (For more on that, see last month’s Bloomreach Commerce Pulse article that took a look back at “A Year of COVID-19”.)

But with vaccinations ramping up in the United States in March and April, what will that mean for grocery stores?

As of March 1, 10% of Americans were fully vaccinated. By May 4, 32% of Americans were fully vaccinated. An incredible effort in 64 days on the road back to normalcy.

A popular hypothesis has been that as the vaccine rolls out people will return to pre-pandemic behaviors and impact online grocery sales as people return to pre-pandemic routines. It is certainly reasonable to expect a decline, but how much?

Before we go into hard numbers, let’s learn what was on the minds of those shopping with our Bloomreach customers.

Search Terms

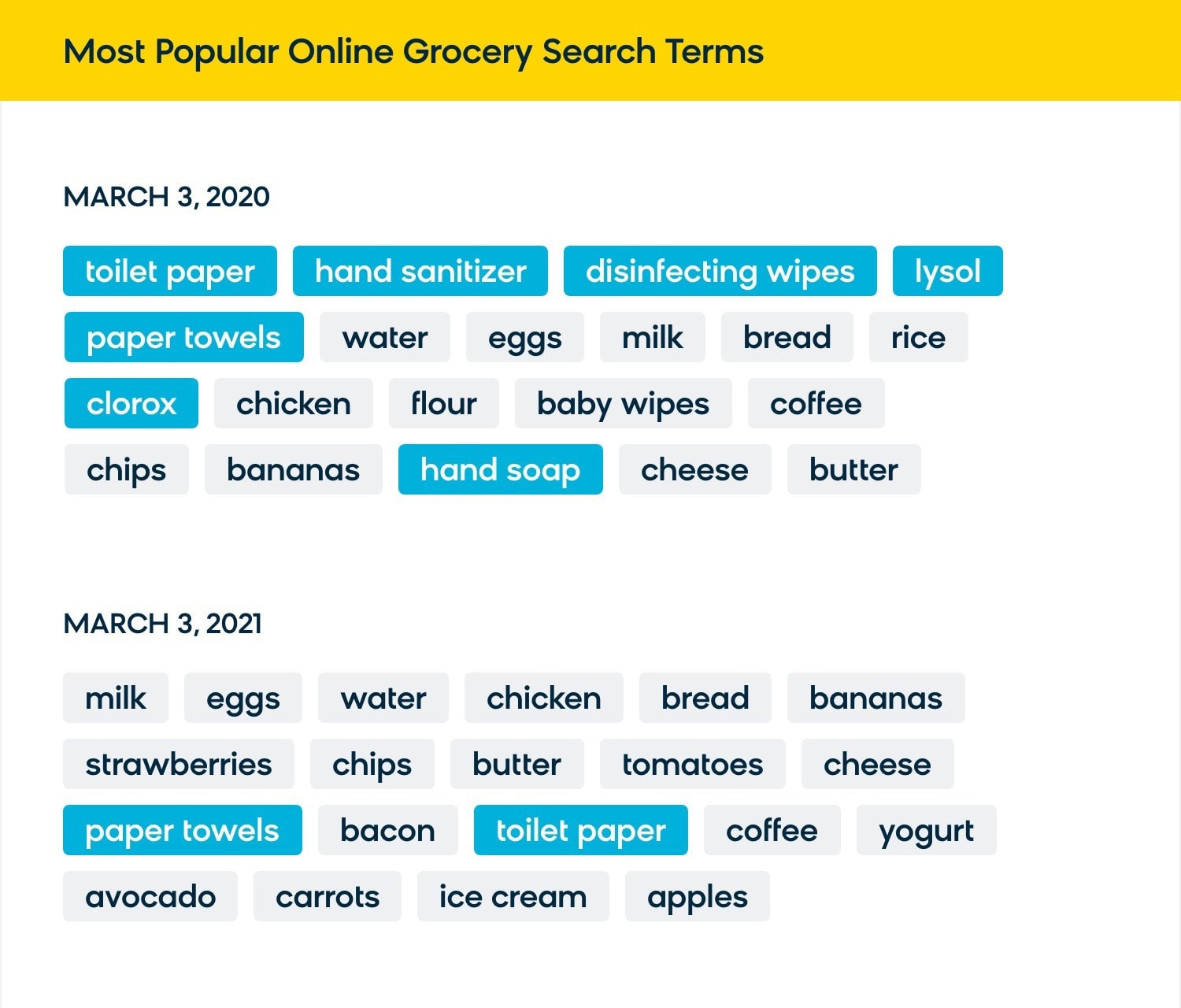

One of the best ways to get insight into what shoppers want is to see what they were searching for. A look at search terms on the day the United States ramped up vaccine distribution compared to one year earlier paints a picture with very different things on the minds of seekers.

As expected, search terms are drastically different comparing March 3, 2021 to March 3, 2020. But there are some important data points here to explore that tell a larger story.

- In 2021 we see more fresh produce items, such as fruits, vegetables, and other kitchen staples, appear in top search terms.

- We see COVID-related terms slip out of the top 20 and only common staples of ‘paper towels’ and ‘toilet paper’ remain.

- Milk is still king. Even as more and more alternatives to dairy milk become common (my daughters got me to switch to oat milk this year), we still see ‘milk’ as the top search term.

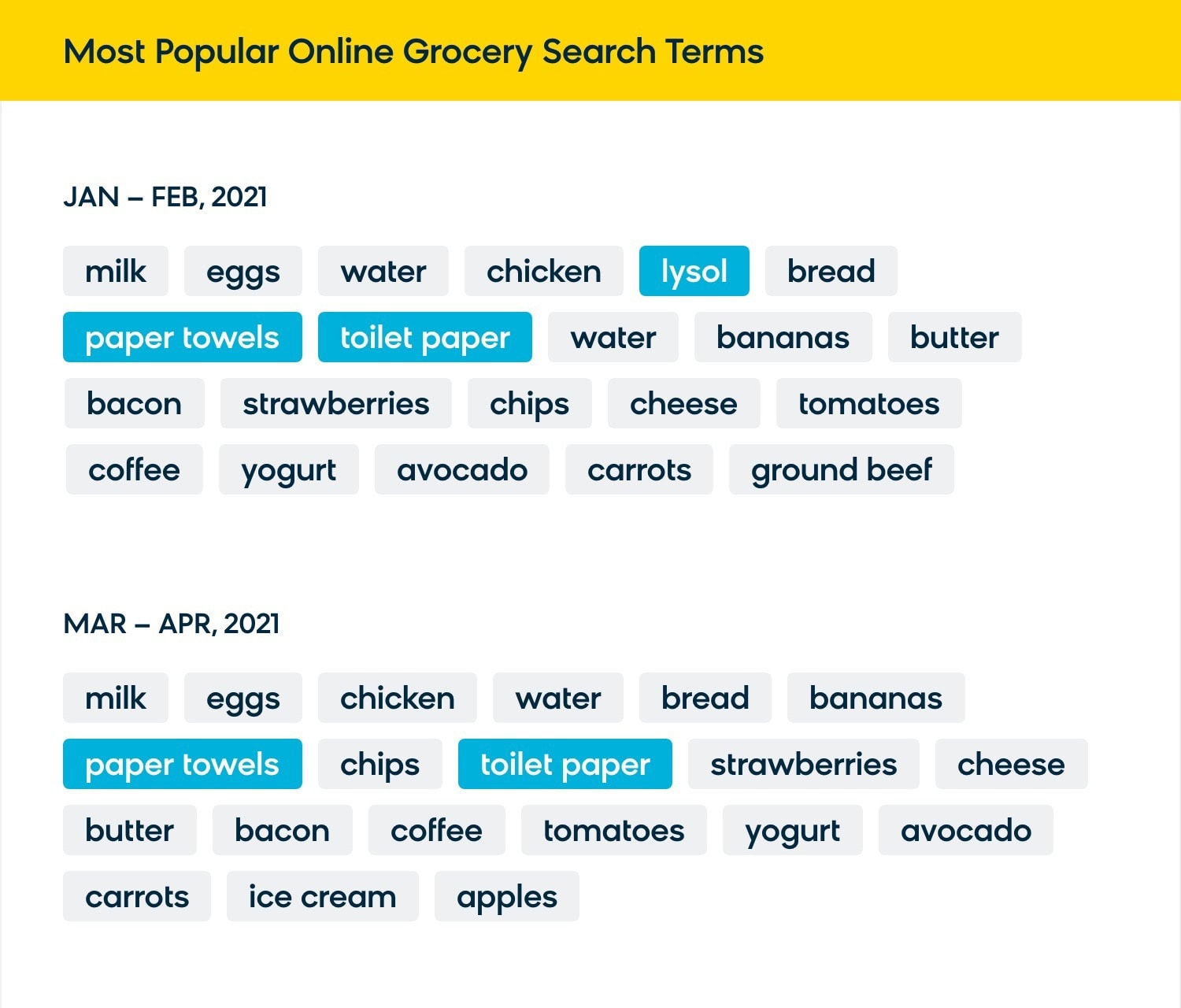

While our search terms don’t look drastically different from Jan-Feb to Mar-Apr 2021, there is one extremely important and noticeable difference: lysol.

Lysol went from being the fourth most searched term in January and February to being off the list completely in March and April. This leads us to believe that the vaccines are easing the minds of American shoppers and COVID-centric products are no longer top of mind.

Traffic

Let’s get into the hard numbers. Did the vaccines send shoppers sprinting back to brick-and-mortar grocery stores?

Not exactly.

When comparing March and April to last year, traffic is down about 22% year-over-year. But this period was also the peak seen early on in the pandemic when there was so much uncertainty that led to online grocery traffic exploding and people were hoarding and stocking up, not knowing exactly what was ahead.

However, in 2021, traffic is actually up 6% overall since the vaccines ramped up in early March. That number is in comparison to the beginning of 2021 when less vaccines were being administered.

So while traffic is down from its all-time high during a time when many were shuttered in, traffic is up from the beginning of this year despite more shoppers being vaccinated. While traffic may never again reach our early pandemic all-time highs, it has not fallen off dramatically either.

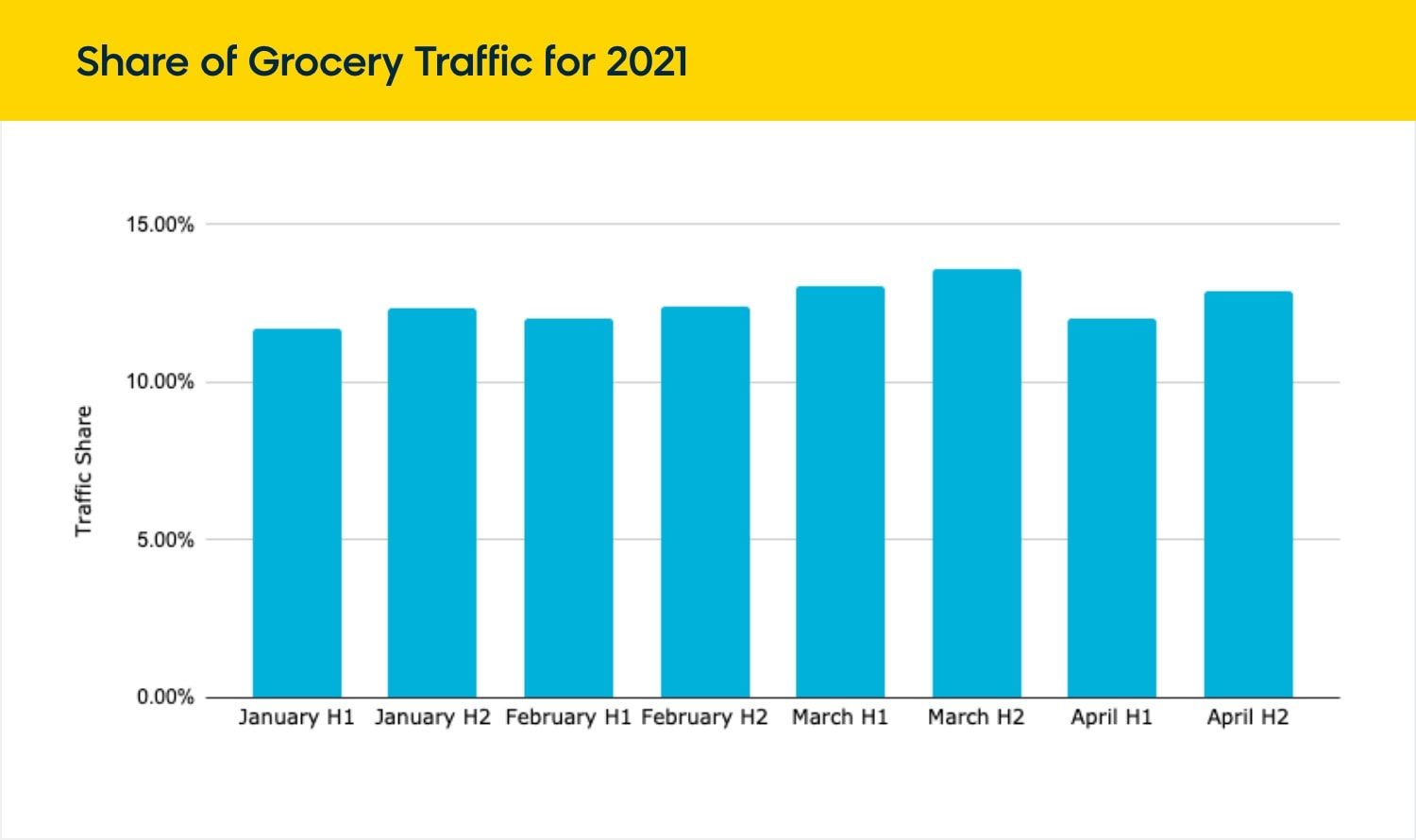

To visually portray the picture of traffic in 2021, we’ve used our “traffic share” metric and split January-April into eight sectors (half of each month). Traffic share refers to the amount of website visits seen in a specific timeframe (in this case, the half months) when compared to the total visits for the entire period. The total percentage adds up to 100% for the eight sectors.

Despite a small dropoff in the first half of April (thanks to low traffic on Easter weekend), it’s visually obvious that online traffic has increased as more Americans have become fully vaccinated.

Conversions and Sales

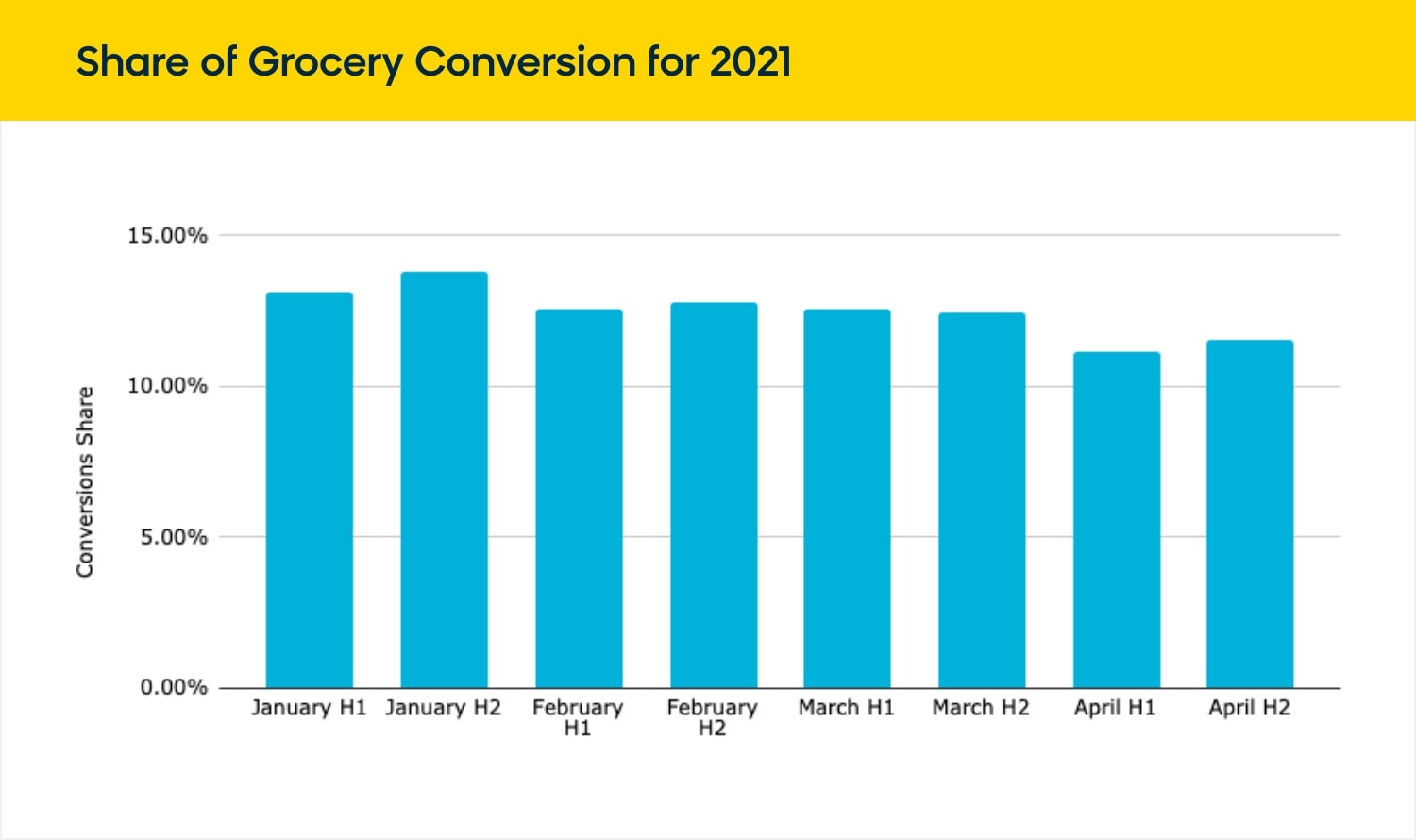

While traffic is up, conversions are down when you compare March and April to January and February.

Like “traffic share”, our “conversions share” metric helps to tell the story of the first four months worth of conversions in 2021.

The share of the number of conversions in 2021 reduced by 8.67% when comparing the number of conversions in January and February with those in March and April. This is mostly because of the reduction in conversions in the month of April.

Declining conversion numbers showed up in monthly sales as well as overall sales which were down in April 7.69% compared to March despite average order size being up 2.98%. This was after sales were up 21.40% in March compared to February.

What Does This All Mean?

The search terms and numbers tell an important story for the online grocery sector: it has carved out its spot in our lives and is here to stay.

While the entire country is not yet vaccinated and we will continue to learn more as we go forward, it appears online grocery will remain well ahead of 2019 levels even if there is some fall back to the early-pandemic peak of spring 2020. Customers have grown accustomed to the convenience of digital commerce and built a habit that won’t soon break.

Some normalization is expected, and there is no doubt that people are yearning to head out to dine and maybe even shop. But as work-from-home and the convenience of online shopping for busy people remains top of mind, online grocery shopping – with delivery and pick-up options – will become a normal pattern going forward. It will not only stabilize, but likely grow from here.

To Learn More

If you’re interested in learning more about these data points or any others with industry experts, sign up for Commerce Pulse Quarterly: Spring 2021 on June 29. Our experts will lead an interactive roundtable discussion that will explore unique insights in digital commerce and discuss changes in consumer behavior and purchase patterns across the landscape.

If you’re looking for even more on the overarching state of digital commerce, register for The Commerce Experience Summit 2021 on May 26-27. Experts from all corners of ecommerce will gather to discuss their best tips and tricks for capitalizing on this unique time in digital commerce history.

About Bloomreach

Bloomreach powers 25% of US and UK ecommerce search and commerce experiences. If you’re looking for more information or have a question, feel free to reach out to learn more. We will be bringing you monthly insights as we navigate the changes in digital commerce together — whether you are a customer or not.