Bloomreach Commerce Pulse: Update on US, UK, & EU eCommerce Traffic & Sales - Wk of March 8-14, 2020

By Brian Walker

03/17/2020

The week of March 8, last week - though it feels a lot longer ago to most of us, was a turbulent one to say the least. It seemed as if the pandemic went from a regional emergency focused on China, Northern Italy, Seattle, and a few cruise ships to a national and global crisis overnight.

Consumers began to prepare even as mixed messages were hard to parse. But as businesses, events, and sports leagues began to close, suspend, and cancel, consumer buying patterns and sentiment began to change quickly.

The markets reacted, creating a double shock to populations across North America, Europe, the United Kingdom, and beyond - making a public health crisis into a global economic crisis as well.

Bloomreach powers ~20% of US eCommerce search and commerce experiences, and we have received a number of inquiries on what we are seeing across the 300+ global enterprise eCommerce businesses - many of whom have multiple brands and sites.

We hope this gives you and your business a perspective on how our industry as a whole is fairing in these turbulent times.

eCommerce Traffic and Sales - Week of March 8-14, 2020

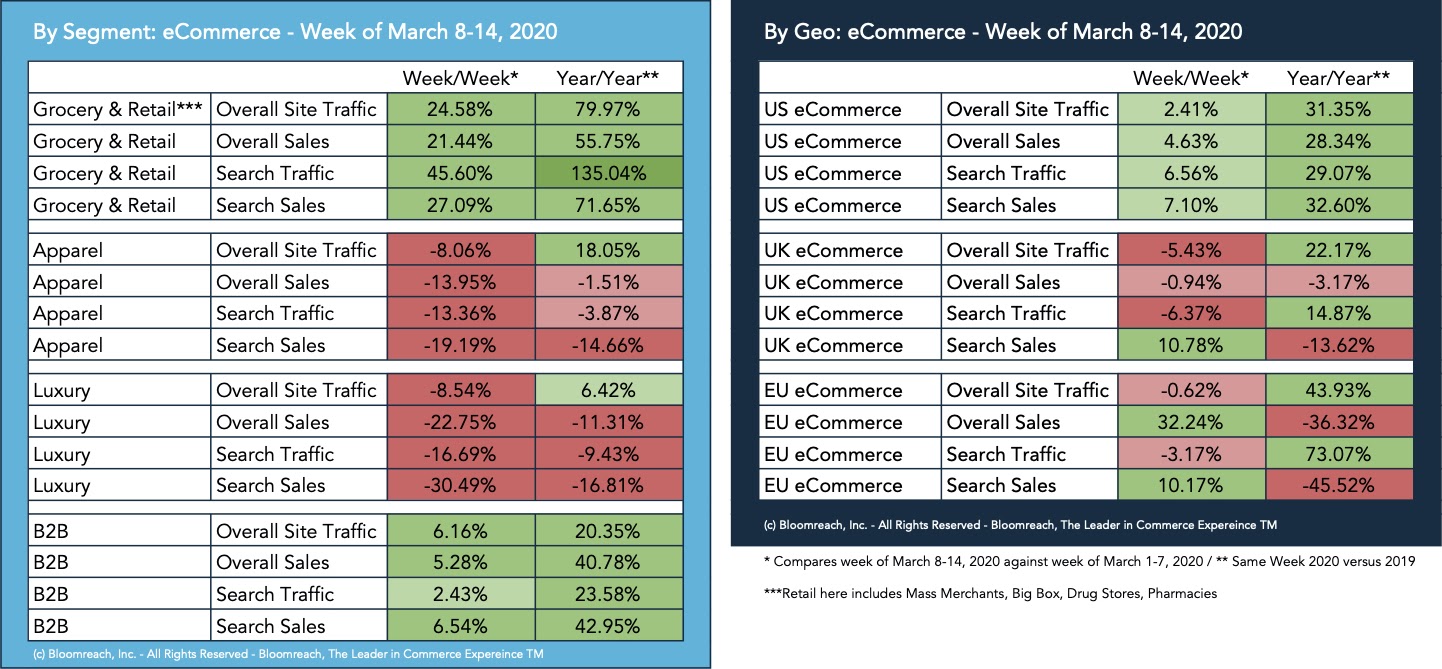

Below is a view into our data, which tells a story of eCommerce demand across regions and segments:

What we can see in the data:

- Consumers world wide began leveraging online channels for food staples and supplies to disinfect themselves and their surroundings. You can see with the spike in search traffic and sales, that consumers were after specifics as search related sales outpaced gains across the whole experience.

- Luxury took a big hit as consumers were in no mood to shop for luxury goods across all three markets. Coming off the hit to China’s demand for luxury goods thus far in 2020 (though thankfully there are signs China may be coming out the other side), this presents a quadruple play of bad news for luxury brands. Apparel was also down, though modestly in contrast to the Luxury segment. This week’s data may be a different story.

- UK saw spikes in traffic and searches, but lower sales year-over-year. This may be an indication of supply shortages or sale oriented shopping. On the heels of Brexit, UK shoppers may be a bit indecisive as COVID-19 swirls in the news cycle.

- EU saw a curious pattern of spikes in overall traffic and searches, but much lower sales. This is likely a reflection of supply shortages, but more likely indicates a rush to physical stores to grab the items in stock via the website.

- US eCommerce spiked across traffic and sales. Many across the US started to tune into the crisis and prepare, but did not necessarily tail off discretionary purchases across apparel and luxury, leading to an overall very healthy week. We will of course be watching closely to see how this week contrasts.

- B2B eCommerce is seeing significant gains year-over-year across regions, building in demand throughout 2020. This may be an indication of B2B customers stocking up on essentials given the supply chain shocks on the heels of China’s coronavirus shut-down. It will be interesting to see how demand evolves from here with businesses forced to temporarily shut down in many places. Let’s hope that is short-lived.

If you have any further questions, I encourage you to reach out here, and we will follow up with you ASAP. We have additional data we are processing and aim to bring you further insights each week as we navigate these challenges together - whether you are a customer or not.

Be well. Be safe.

Further Reading

-

[COVID-19 Content Hub]: Metrics, Insights and Analysis on eCommerce Trends

Found this useful? Subscribe to our newsletter or share it.