Bloomreach Commerce Pulse: Update on US, UK, & EU eCommerce Traffic & Sales - Wk of March 22-28, 2020

By Brian Walker

03/31/2020

The week of March 22 saw much of the United States, Europe, and the United Kingdom settle into an odd state of ‘the new normal’ for those who continue to work - foreseeable future - from home, and a new level of crisis for those directly impacted by furloughs and layoffs.

McKinsey released updated consumer sentiment numbers that reflect consumers attitudes toward essential and discretionary spending, a shift toward preferring online channels, and the hopeful signal of Chinese consumer confidence returning. It goes without saying that we hope for a quick recovery - for everyone impacted either directly by the virus or the resulting profound economic impact of the ‘shut-down’ of the pre-COVID economy.

Bloomreach powers over 20% of US & UK eCommerce search and commerce experiences across the 300+ global enterprise businesses - many of whom have multiple brands and eCommerce sites.

Update on NA & UK+EU eCommerce Traffic and Sales - Week of March 22-28, 2020

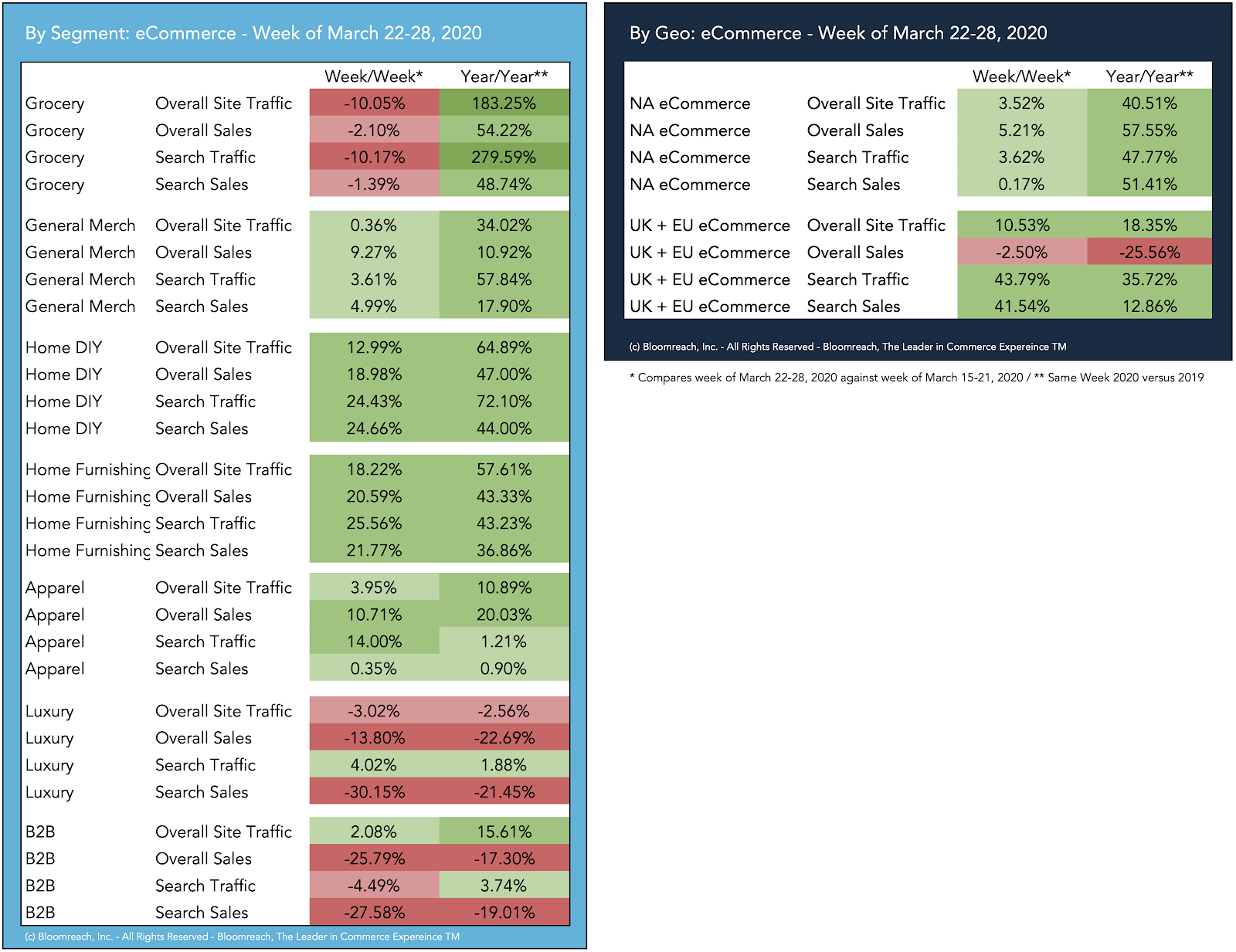

Below is a view into our data, which tells a story of eCommerce demand across regions and segments. Let’s get into the numbers.

What we can see in the data:

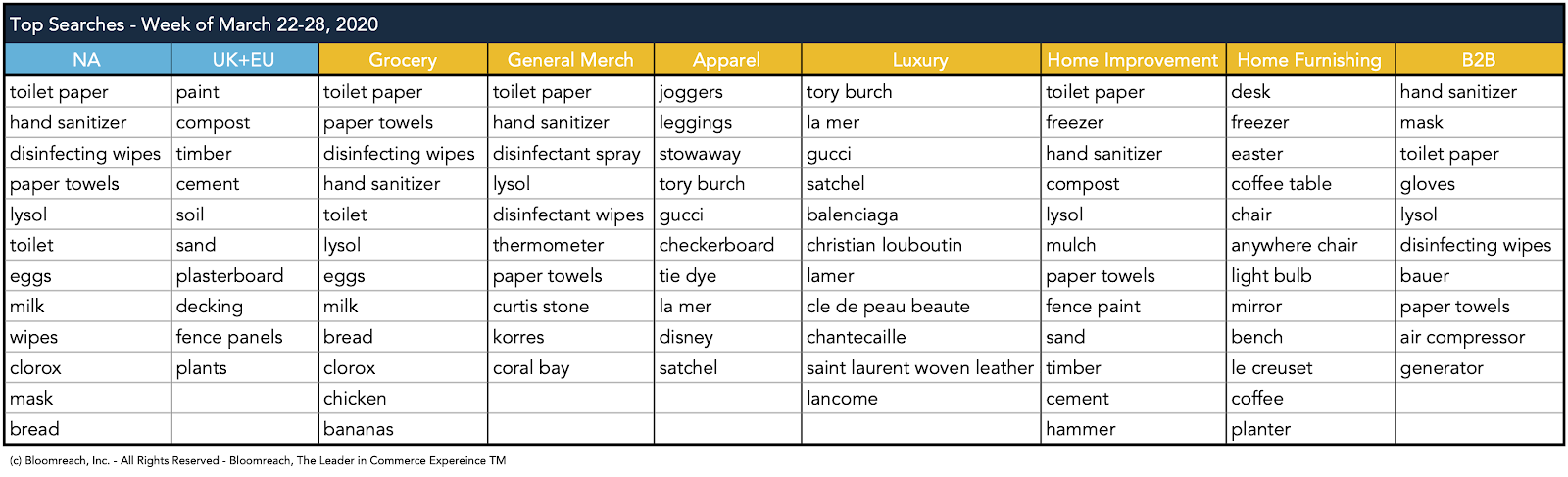

- Grocery eCommerce has slipped slightly week-over-week compared to March 15-21, but remains very strong versus last year. This likely reflects a slight drop due to consumers having stocked up in previous weeks and the challenge of finding delivery or pick-up slots some have reported. The exceptionally high search traffic reflects consumers seeking very specific products both to stock the pantry and to keep safe. The General Merchandise segment is also up, but to a lesser degree.

- The Home Improvement/DIY segment saw much higher traffic and sales this past week versus last year as consumers seek out-of -stock items they can not find elsewhere - as we can see in the search data. Consumers are also taking time to complete home and garden projects they otherwise had little time for, as we can again see in the search data where both garden and home improvement supplies are now trending.

- The Home Furnishing category also saw much higher traffic and sales this past week, as consumers sought furnishings that help them work from home more effectively and comfortably. We can also see coffee maker, bread maker, and cookware brands appear in searches as people are setting up for a different routine and lifestyle centered on their homes.

- Apparel is holding steady, buoyed by promotion and as consumers looking to ‘zoomify’ their wardrobes. Comfortable and leisure apparel saw an understandable jump in searches. 'Tie dye' made an interesting appearance, perhaps reflecting homeschooling and retro trends now in vogue.

- Meanwhile the Luxury segment is struggling, though the relative level of search traffic indicates consumers are looking for very specific brands - likely hoping to find them on sale during what is now a very promotional period as luxury retailers and brands seek to move inventory.

- B2B has shown a bit of a slowdown this past week, after multiple strong weeks. This may reflect the overall business cycle as businesses are forced to close or employees work-from-home. Search terms in B2B reflect many of the same products consumers are seeking for their homes, perhaps reflecting both the needs of businesses for products to keep employees and customers safe.

- NA eCommerce remains very strong overall in comparison to last year, even growing week-over-week. This reflects a strong three week trend of year-over-year and week-over-week growth. Consumers are gravitating online to fulfill essential and non-essentials alike.

- In UK & EU we see a significant drop in overall sales, even as traffic remained strong last week. This likely reflects the pressure on supply chains and logistics, with some fulfillment centers being forced to close. The ongoing trend of strong search traffic and sals shows consumers are trying to use these channels to locate and buy products, likely with in-store pick-up or buy-online-pick-up-in-store options.

You can find all of Bloomreach’s Coronavirus related research, including previous weeks, on our Coronavirus Content Hub. If you have any further questions, I encourage you to reach out here, and we will follow up with you ASAP. We have additional data we are processing and aim to bring you further insights each week as we navigate these challenges together - whether you are a customer or not.

Thank you and be well.

*McKinsey survey data: American consumers Mar 20-22, 2020, U.K. consumers Mar 21-22, 2020

Further Reading

-

[COVID-19 Content Hub]: Metrics, Insights and Analysis on eCommerce Trends

Found this useful? Subscribe to our newsletter or share it.